Why is anyone surprised Christine Lagarde stepped in it? This is who she is, who she has been her entire career. The woman is a walking disaster, screwing up from one place only to be promoted into the next. Her Argentina debacle was merely the latest – before yesterday.

In case you were distracted by events closer to home, the S&P 500’s epic drop, in Europe the stock crash was even worse. Imagine that, for many European exchanges the day saw record declines. The downdraft was part of these global liquidations, to be sure, but the ECB’s relatively new and untested Governor was responsible for that last shove over the cliff.

At her press conference announcing yet more QE and other assorted “aid”, she casually dismissed rising credit risks. “We are not here to close spreads,” Lagarde belched, and immediately shares puked (appropriately disgusting metaphors, both). True or not, the first rule of central banking is not to make the situation any worse (a task that’s been made much harder this time around by a decade’s worth of QE parades).

Thus, she stepped all over her grand announcement. She Trichet-ed her first move, an entirely predictable result given her career trajectory.

The media continuously calls her a Rockstar no matter what, and will continue to do so as Europe sinks. The term is brought up every time she manages to fail further up the ladder. There were the glowing profiles in 2011 when she was promoted to take over the IMF under cloud of criminal suspicion, and then again in 2016 curiously timed to cover the French court finally finding her guilty of that very negligence from back when she was France’s finance minister.

Such a finding should’ve been the end of Lagarde, and while the court imposed no fine or prison sentence she did receive several high profile accolades including entry into Glamour Magazine’s 2016 Women of the Year (the citation didn’t mention the negligence verdict).

I’m well aware of the admiration and the recognition I can attract, especially among women. It’s an extra responsibility. You don’t have the right to disappoint.

Yet, that’s all she’s done. Early in her public career, beginning in 2005 with appointment to Trade Minister, the French press dubbed her Christine LaGaffe. She was that prone to making tone deaf statements and being aloof.

While not necessarily fatal flaws, how does a person such as this become head of a major central bank (or IMF) whose entire purpose is to manage people’s expectations? Without any actual money in monetary policy, what’s left is, ahem, credibility; the appearance of it, at least.

In truth, Lagarde is a perfect match for this ECB at this time. Corrupted and incompetent, the only real way out of this mess is to reveal what’s behind it so that the thing can be torn down and we can all start again with something better; something accountable somewhere. Given enough time, Christine LaGaffe just might manage to bring the whole thing down on her own, even if unintentionally.

What she is, at root, and what has sustained her thus far, is her pure bureaucratic nature. She knows the game, and its routines. Central banks are not banks at all, they are governments without any natural constituency. As I wrote elsewhere today, the absolutely perfect week to be bringing up Walter Bagehot, the thing has devolved exactly as he discussed back in 1867 (writing about governments rather than central banks).

It is an inevitable defect, that bureaucrats will care more for routine than for results; Their whole education and all the habit of their lives make them do so.

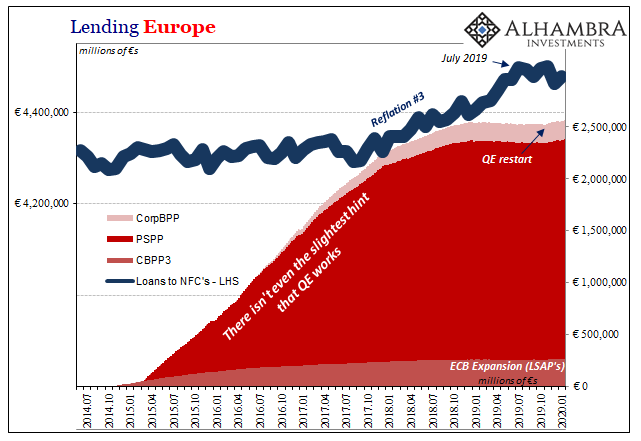

What is modern central banks but their routine of botched QE’s? What is Christine Lagarde but her routine of botching everything, including, now, the re-re-launch of one QE? Her first big test and she already fits right in.

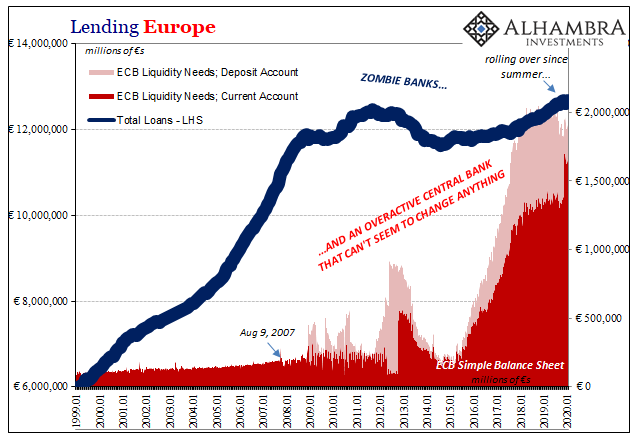

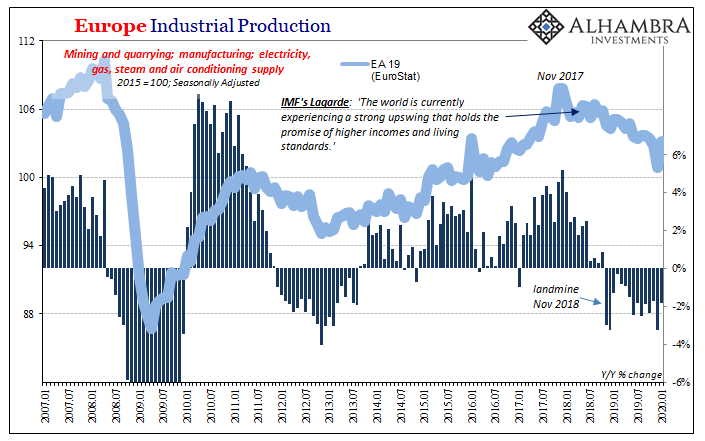

Europe was already at the brink before thanks to Mario Draghi’s similar incompetence. The only difference between them was his more natural gifts of tact and media savvy.

The European economic plight will now have to factor not just this recessionary starting point, which began a long, long time ago, but now pile on top coronavirus fallout and the same sort of thing from an as-yet unknown level of unfolding market dislocation(s).

But Jay Powell [like Lagarde] doesn’t care. Not really. QE is the central bank’s post-2008 routine. That’s what they do; what they all do. Effectiveness is, believe me, subjective. When it does fail, as the others have, volumes of econometric literature will spring up declaring it a success by declaring success a miniature of its promises. QE lowered term premiums! (in some studies.)

The real world has much bigger problems on its hands. A little technical proficiency would go a very long way, not unlike the kind Walter Bagehot had in mind a very long time ago. Indeed, what might hold the greatest chance of successfully mitigating this unfolding disaster, more than a coronavirus vaccine, is some good ol’ fashioned currency elasticity.

To paraphrase the ECB’s gaffe-in-chief, she is not here to close monetary spreads, either. Even if she could.

Stay In Touch