The people who believe they are the Federal Reserve’s biggest critics are actually Jay Powell’s most vocal supporters right now. Rather than being bothered by all the “Weimar” memes and printer-go-brrrrr jokes, US central bank officials welcome such free press (pun intended). Anything that contributes to the idea there will be inflation – a little or a ton – helps current monetary policy achieve its objective.

And let’s be perfectly clear as to what that objective is: not inflation itself, no, the acceleration in consumer prices is presumed to be nothing more than a byproduct. A byproduct of what? People saying there’s going to be lots of inflation.

It doesn’t matter if these claims come from the most vehement of detractors; in fact the more forceful the rhetoric the more Jay Powell believes it will move the needle toward this preferred side. The truth is he needs all the help he can get; the evidence is unequivocal about what’s really going on.

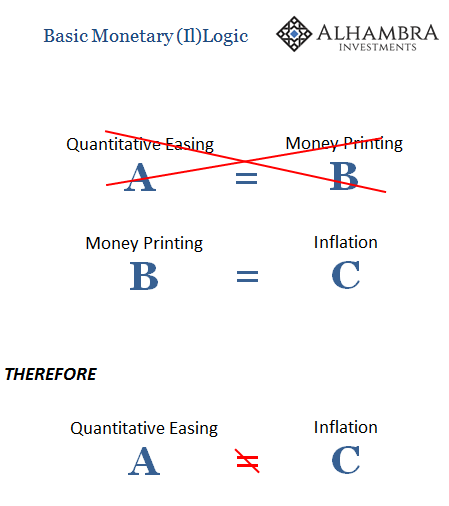

The Fed does not print money. Sorry, it doesn’t. More to the point, it wouldn’t even know how. Thus, there’s absolutely no inflation nor any danger from it. Instead, the dangers continue to stack up relentlessly on the other side, the side of the worst form of monetary disease and it’s not the one the critics all claim. They may hate him, but right now Jay absolutely loves what they’re saying.

If only this was enough.

Over here in reality, it’s not even close. Money-less monetary policy leaves the economy exposed to, you know, monetary problems. To counteract them the Federal Reserve’s toolkit consists entirely of myths, legends, and fairy tales, but myths, legends, and fairy tales given the gloss of plausibility by the financial media as well as those who hang entirely on the “money printing” story they’d also like to sell you.

This is something Ben Bernanke would’ve told you already if the guy could be honest with himself (hero!) first before coming clean with the rest of the world. Like Chairman Jay, Chairman Ben had been accused of the same things; destroying the dollar and sacrificing the US economy at the altar of money printing excesses which would “inevitably” lead to seventies-style Great Inflation #2 – at best. The word hyperinflation was tossed around with some regularity.

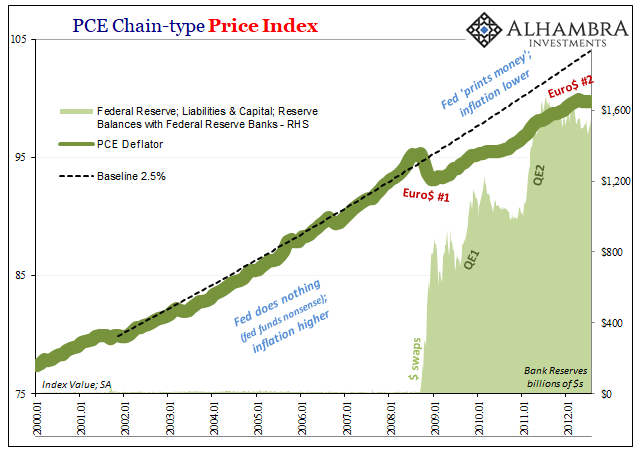

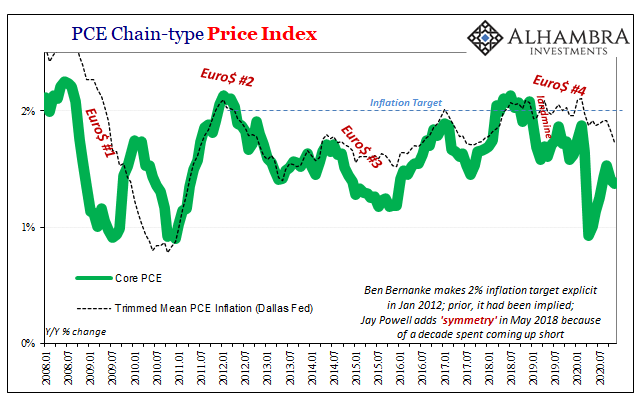

The evidence conclusively disproved this nonsense. To begin with, the fact there had been a Global Financial Crisis had already exposed the weaknesses of fairy tales in the face of a true monetary disease (which currency grew most destructively inelastic, though?) And in its aftermath, same thing. Bernanke had his QE’s, his critics, and his critics hugely critical of his QE’s for all the same reasons the Fed did QE.

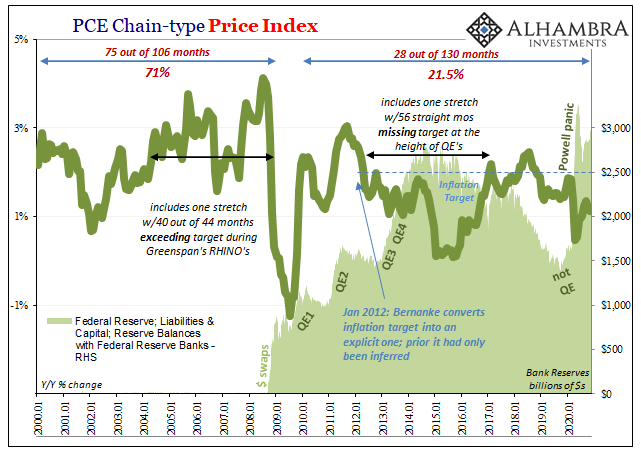

No inflation. Less, in fact. Conspicuously less; the second chart immediately below really exposes all these money printing fallacies:

The more the Fed does in direct “money printing”, the less the inflation that will result. Not because of the QE’s, rather the simple fact that QE is a response to the symptoms of the same thing already squeezing the life out of the economy therefore the pricing power from companies (worldwide) by destroying labor.

This is, and remains, the eurodollar’s world and there’s no place in it for such monetary fakery. You can’t cure a true monetary shortage when all you’ve got is easily disproved stories about some ridiculous Greenspan “put.”

As if this decade-old US experience hadn’t been enough to “put” all this to rest, there was Japan’s versions of QE and LSAP’s along with those of Europe. In April 2013, the Japanese, for anyone left to doubt, tested what they said had been the outer limits of digital-bank-reserve-printing-insanity under QQE.

Predictably, nothing. No recovery, no spark, and thus no inflation. This isn’t really about consumer prices.

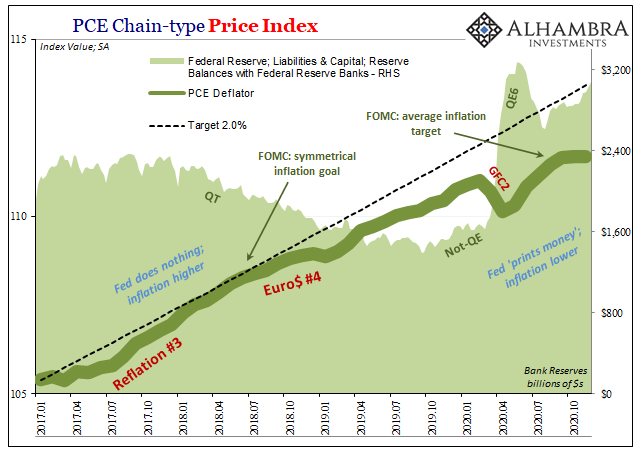

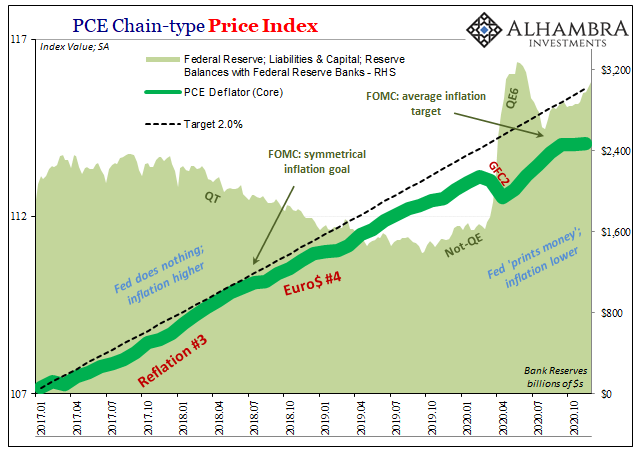

Jay Powell’s Fed hadn’t just one-upped QQE in March 2020 with Japan-levels of bank reserve action. The US central bank also borrowed what the US central bank had previously borrowed from the Japanese. In September 2016, the Bank of Japan unveiled a target of “overshooting” – and then promptly watched helplessly as the undershooting got worse.

Undeterred by such empiricism, the “data-driven” Fed in May 2018 declared it would follow the same methodology anyway; rebranding “overshooting” as “symmetrical”, and then promptly watched helplessly as the underside, the wrong side of symmetry got worse.

In August 2020, paying no heed to even more years of the same proof, Powell’s grand strategy review settled upon an “average” inflation target – which was the same thing as overshooting and symmetry. And, you guessed it, over the intervening months Jay’s had to watch helplessly as the undershooting only gets worse.

You just can’t make this stuff up; if you did, you’d be laughed out of polite society. And yet, this is what really goes on with “monetary” policy.

Its secret is simply the financial media; not the secret to success, of course, instead the secret to maintain what is a thoroughly corrupt enterprise. The worst part may be what I stated at the top, how those who already know the central bank is corrupt – but can’t figure out exactly how. Because they don’t know the details of the monetary system (anyone using the M1 and M2 data is your first clue) they end up contributing perhaps the most to it sustaining this inflation fantasy, and the Fed’s current format, a little while longer.

Welcome to the 1960's. Please note the year. And that this is from the FOMC (meaning, the last people to figure these things out. Well, almost the last). https://t.co/0BzHCt3h39 pic.twitter.com/sKHEdr67XU

— Jeffrey P. Snider (@JeffSnider_AIP) December 15, 2020

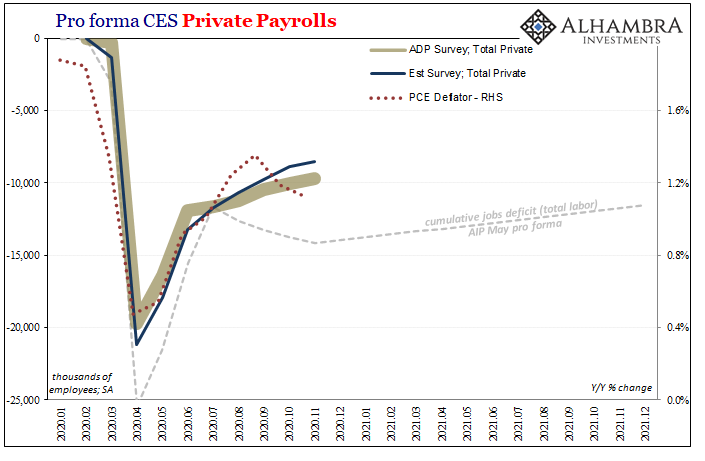

The Bureau of Economic Analysis (BEA) reported today on the Federal Reserve’s favored inflation measures: the PCE Deflator and its core. Neither are anything like inflationary. The headline rate was just 1.13% year-over-year during November 2020, down from (revised) 1.19% in October and 1.35% throughout September.

The reason for the deceleration is obvious on the charts above: consumer prices in the US, broadly speaking, have come dangerously close to outright deflation for three months running!

Those three months – September, October, and November – follow six to now nine months of huge “money printing” and all the absolute certainty by which the inflation-ists scream at the tops of their lungs about the currency debasing fires of DOLLAR CRASH!!!!! and BOND ROUT!!!! Month after month after month (after month), and…?

But that particular triumvirate also comes on the heels of the quite deflationary, in a real-world sense, summer slowdown. Looking past the inflation, money printing farce, the data matches what’s actually taking place in the monetary therefore financial as a result economic system. Again.

This isn’t about oil prices, either, as the core rates of inflation similarly drift disinflationary at best. In monthly terms, the core PCE measure is decelerating, too, and the index (seasonally-adjusted) has flatlined since August; it is now up all of 0.2% total during those three months (for a sizzling annual rate of 0.82%, which would be among the lowest on record).

Even if you didn’t know the details of the monetary system, and weren’t quite sure what role bank reserves might play in it, the evidence is overwhelming.

Wherever it’s tried, the results are exactly the same. No inflation because QE doesn’t fix the monetary drag which holds down economic recovery insofar as most people understand what one is. And there is no real recovery because QE is all fake. Smoke and mirrors. A ridiculously bad, unimaginative puppet show.

I’ll continue to show you what bank reserves really are, and what the actual monetary system is like, but you don’t even have to take my word on any of it (some people never will). Just be honest about the evidence. The mountains of it.

Stay In Touch