There are those people who will remain convinced forever forward that the Federal Reserve is run by evil geniuses absolutely intent upon robbing the free peoples of the United States of their financial freedom. As evidence, they point to one unsuccessful, controversial monetary policy after another, none of them effective at accomplishing their main task of putting the economic and financial order back together again following the suspiciously (their word) timed 2008 monetary crisis.

In other words, to be so consistently and inanely inept can only be by design.

The repo market events of September 2019, and the policy response to it, made it even harder to argue against this proposition. Finding out money dealers worldwide had responded to technical illiquidity in this key space, Jay Powell’s crew decided that they’d just do more of what the Fed has always done post-GFC1: increase the level of bank reserves.

Never mind that bank reserves had been made “abundant” during the worst parts of that earlier crisis and on it came anyway, the plot always thickens, as they say, the truth is far simpler; central banks are unable to intervene monetarily so they are left to pretend. The byproduct of such pretense is those bank reserves.

A silly game, sure, but not necessarily neutral by any technical standard. In order to create these reserves, the central bank’s policymaking body, the FOMC, must direct its Open Market Desk operating at its New York branch to purchase assets from primary dealers. Nothing more than an asset swap, so far as the public may be concerned it looks like money printing simply because on the one side the Fed’s balance sheet has substantially increased (with those bank reserves serving as the arithmetic remainder).

But what about the dealers?

Having transacted with the Open Market Desk, they now have a greater balance on account with Federal Reserve (reserves) having exchanged out of their title, and substitution rights, whatever security the FOMC demanded.

If the Fed wished to buy exclusively, say, T-bills, then the banking system will be left with fewer of them while more of those reserves. This was, in fact, the exclusive method policymakers chose to fortify (their word) the financial system and repo market in the wake of 2019’s big rumble. Declaring this not-QE, its purpose was to stay out of notes and bonds (which, officials believed, the public would believe indicated a QE) while scooping up just bills to accomplish raising the systemic balance of fantasy reserves.

You couldn’t have made the situation any worse if you had tried. I said so many times before March 2020, including here all the way back in October 2019:

It’s hard not to think sometimes that maybe the conspiracy theorists are on to something here. When you step back and look at what they are doing, there are moments when you truly wonder if authorities are actually trying to crash the system. At least to make a bad situation that much worse.

The whole bond market screams systemic collateral shortage and these guys think, well, let’s fix it by…removing the best collateral from circulation. Can anyone in such a position really be that obtuse? It has to be on purpose, right?

The issue, as it almost certainly had been in September 2019, remains something called securities lending; or what in Europe their slow-walk authorities are characterizing as Securities Financing Transactions (SFT). However you label it, the use of financial assets – the highest quality debt instruments in particular – which underpins a whole lot more of the world than most people, these very policymakers included, wish to realize.

Exchanging T-bills for bank reserves, repledge-able collateral absolutely essential for wide systemic funding use replaced by inert, unexchangeable bank reserves, was akin to removing “base money” from the global monetary pyramid which September 2019’s repo market already told anyone paying attention had been under serious strain.

Powell’s people simply did what the Fed does; and that’s the real problem especially since much of the original Global Financial Crisis can be traced directly back to this same stuff.

Not malice, pure corruption where the actual corruption is the institutional inertia which prevents progress in monetary knowledge. In the simplest of terms, central bankers have proved incapable of learning from their multitudes of mistakes.

Setting the world up for March 2020, then, when the collateral bottleneck we’d long predicted sure enough did materialize there was available so much fewer T-bills to calm the long collateral chains imploding backward bringing about so many worldwide firesales and liquidations. It might’ve happened anyway given the introduction of junk collateral years before, but there is no doubt – in my view – that the situation grew to become so much worse and more devastating than it needed to be had not-QE stuck solely to the classroom chalkboard the prior Autumn.

If having made the situation worse, didn’t policymakers distinguish themselves at least in getting the world out of it?

This is, of course, the narrative the same authorities have been pushing all year; sure, it was bad for a few weeks, but they saved the world 2008-style! After all, there weren’t any additional Lehmans; not even a close call.

If we’re looking at it objectively, like 2008, it’s not Jay Powell we’d turn to for congratulations. To begin with, the Federal Reserve – despite Powell outright lying on 60 Minutes in May 2020, saying they’d “seen it coming” – spent the first half of March throwing one dart after another at the wall, none of its “repo” ops, rate cuts, part-QE’s, PDCF reintroductions, nor bank reserve-raising programs able to dampen let alone stifle the global rout.

It finally, mercifully came to an end in the few days following mid-March whereby the seasonal monetary bottleneck (the same one which took down Bear Stearns twelve years before) had passed.

Beyond that, the accidental heroics (if you want to call it that) of the Treasury Department.

Spurred by necessity, knowing what was coming down the Congressional pipeline, Secretary Mnuchin’s bean counters began selling T-bills into the marketplace – the very same timeframe the liquidations abruptly ceased. The timing wasn’t perfect, but combined with the end of the seasonal bottleneck the supply of new T-bills (after the Fed had been reducing market availability for months on end beforehand) seems likely to have proved just enough initial curative effect.

It wasn’t genius monetary policy, simply an accident of deficit-making; the CARES Act was going to explode the fiscal situation, requiring Treasury to immediately borrow in the primary auction markets. As it did, T-bills first.

If you recall, the risky, most problematic portions of the credit markets, in particular, really didn’t start to turn around until the first few weeks of April when T-bill issuance was up and at its fullest.

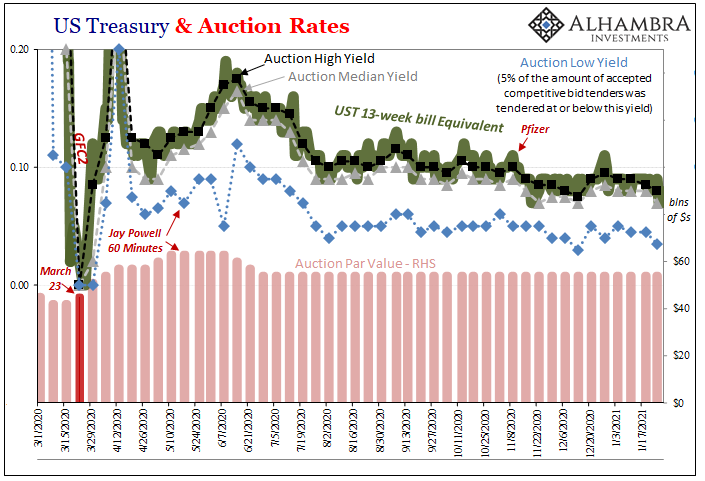

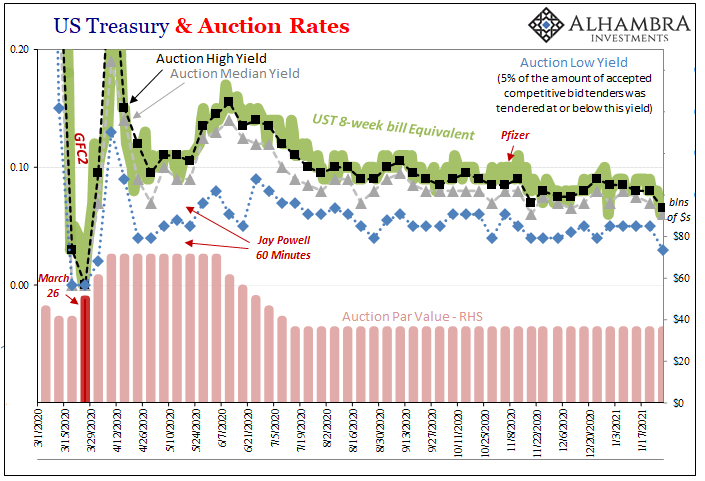

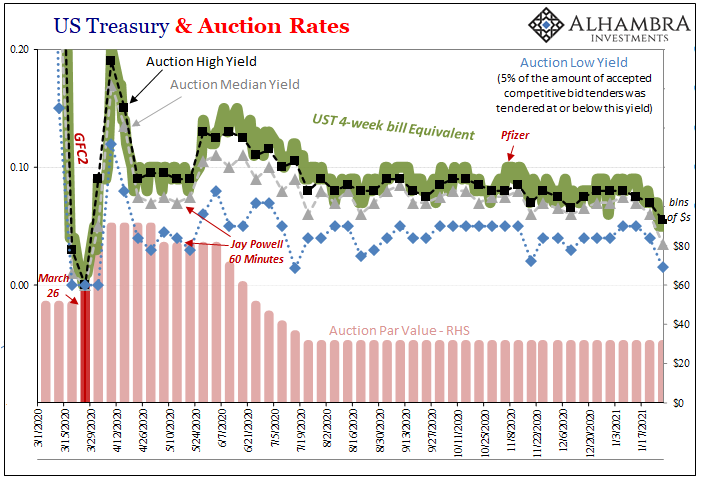

A couple points on the charts above beyond the March supply deluge; 1. Following initial volatility, yields settled down in April with auctions supply at full blast; it wasn’t until Jay Powell’s “we saw it coming”, “digital money printing flood” lies on 60 Minutes that the second jump in yields came up; 2. More important for today, after the initial flood of bills, Treasury cut back on them in the three front tenors (4w, 8w, 3m) all the way back late in June and early July.

The supply situation in bills hasn’t really changed in half a year.

This was nothing more than textbook deficit management. Confronted by an unexpected and unexpectedly huge fiscal shortfall, the debt agency issues short run instruments which are more easily digested in the private market while aiming to convert short run borrowing into more long-term securities over time. Treasury has been doing just this for months.

Notice, however, what that has meant just in terms of strictly T-bill supply. At the 4-week and 8-week maturities, Treasury is supplying less weekly now than before GFC2; not just in comparison to the peak in mid-June, but a ton less than the highest of the deluge.

If Mnuchin’s people accidentally backed into the securities lending business’ partial resolution to GFC2, are they now, for other reasons, committing to the same sin as Jay Powell’s not-QE? In other words, they do appear to have added bills at the bottom and are now taking them away oblivious to the grave considerations at both ends.

As you can see on the charts above, bill yields – and the full set of auction results; median and low bids, too – came down during July and early August. Was that because of less supply, or more demand due to the sudden swing in risk-perceptions as the global economy (especially US labor market) lurched out of its “V” trajectory?

I always say watch the bills. Though I do mean the football team from Buffalo, I mostly refer to Tbills. The most highly prized repo collateral. SFT's and all that.

— Jeffrey P. Snider (@JeffSnider_AIP) January 28, 2021

This has been building throughout January while everyone talks about reflation. Why so desperate for bills? pic.twitter.com/TnfPGQkmOS

But now a second interruption in the wake of Pfizer’s November vaccine announcement; longer dated UST’s (like crude oil) have experienced a modestly reflationary selloff while at the same time the short end bills have done the exact opposite. And as bill yields have crept downward noticeably closer to zero like March, again, there hasn’t been any change in supply for more than six months.

This latest development is all about demand for the lack of further supply.

And that demand seems to have been reinvigorated in January 2021 even as elsewhere it seems inflationary reflation rhetoric has reached another climax. Amazing contradiction, or partially answering the question about why the long end of the yield curve, in particular, like the dollar’s exchange value, hasn’t moved a whole lot more reflationary than it has?

Let me be perfectly clear at this point; I am not claiming there’s an imminent monetary disaster suggested by what’s happening in bill yields, deep collateral implications over another set of possible global liquidations and firesales. What we can say is that, in the same way not-QE left the system’s absolutely vital collateral channel in a decidedly weakened state late in 2019 and early in 2020, the Treasury Department seems to have pulled off the same mistake.

Collateral vulnerability (not inevitable disaster) appears to have increased, repo market participants keenly aware so have the risks and nothing more. That alone could account for the sudden bill demand in January 2021 (along with further uncertainty), though it would be wise to further investigate other, possibly more serious approaches.

Stimulus-phoria and vaccine-phoria don’t seem to have reached these lowest levels of what’s probably most closely situated to a real “base money” product.

“They” aren’t crashing the system on purpose; they wouldn’t even know how. Rather, officials all over the place just do what they always do regardless of the system’s actual needs and condition. It does look the same from the outside either way.

Stay In Touch