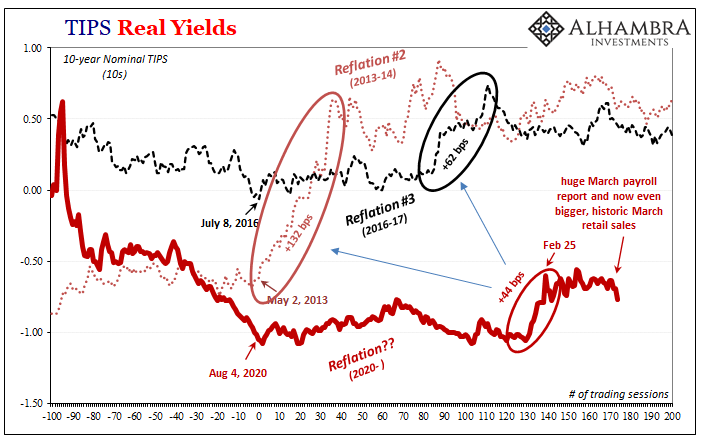

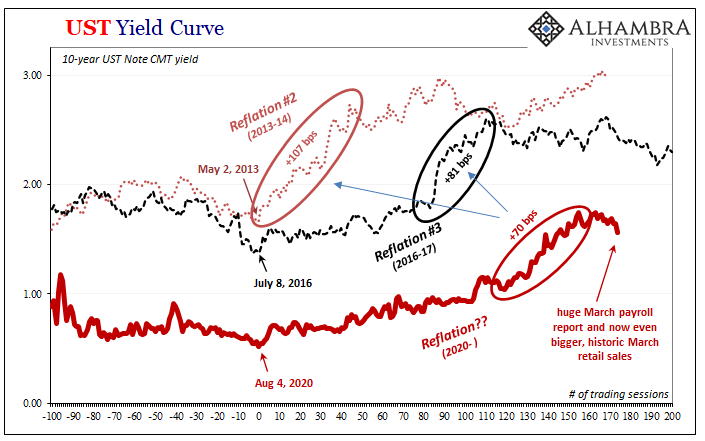

Given the historic data for US retail sales, “somehow” the bond market ignored them yesterday (and today). Yields globally fell for the most part, with real yields (TIPS) really discounting the significance of consumers in March. Bonds aren’t buying that this is anything other than temporary.

Not surprisingly, the mainstream media refuses not to buy what bonds aren’t. I mean, for the fifth time since 2009, bonds vs. Economists (with mainstream media not content to cheerlead, literally working their corner). And even though the former is undefeated against them, they say the market is now wrong.

Seriously, forget all those prior mistakes this one is the one.

If that’s so, it shouldn’t be so difficult to make a plausible case which sticks in more than a few points. Sure, there’s US retail sales, but what else? Uncle Sam can payoff consumers but he’s done it three times so far and following the prior pair there was absolutely no follow-through.

Bloomberg says today, what about China? If you don’t like government influence over US consumers, swapping roles the Chinese Communists have conspicuously kept their visible hands off the Chinese economy. Regardless, retail sales over there exploded higher in March, too, thus making it appear as if recovery isn’t simply being helicoptered in by “stimulus.”

After the U.S. market closed, more information from China reinforced the same theme. A range of official data confirm a stunning rebound. Of most interest is retail sales. China is anxious to stimulate a consumption-led economy, and it looks like it’s getting it.

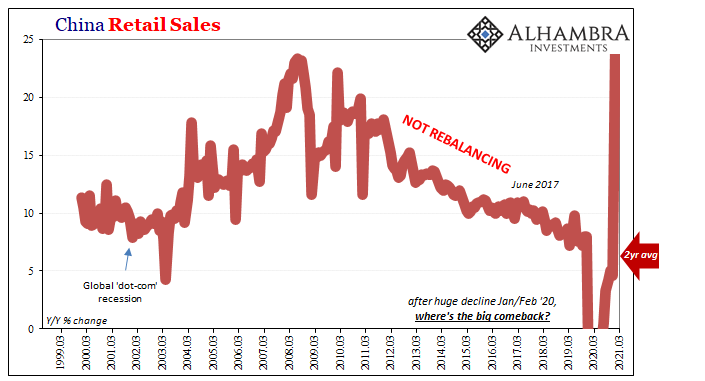

According to that country’s National Bureau of Statistics (NBS), retail sales last month smashed higher by 34.2% year-over-year. That was even better than January-February’s 33.8% annual change, but what’s got the media buzzing is how March’s comparison to the same month in 2020 doesn’t have nearly the base effect within it that the other had (the bottom in retail sales, like all Chinese data, came during the first two months of last year).

Once again today, bond markets shrug off the stunning numbers. While 34.2% sounds unquestionably robust, especially given its slight acceleration from the month before, even the NBS poured cold water all over the excitement. Here’s the very first sentence in the Chinese government’s press release announcing its retail sales estimates:

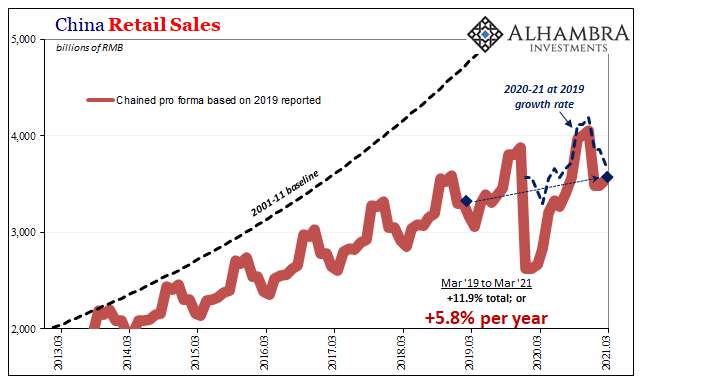

In March, the total retail sales of consumer goods was 3.5484 trillion yuan, a year-on-year increase of 34.2%; an increase of 12.9% over March 2019, and the two-year average growth rate was 6.3%. [emphasis added]

Using an average rate for the 2-year change is still giving it the benefit of the doubt; more appropriately, the compounded 2-year increase was 5.8%. Either one, when you look at the numbers this way an entirely different interpretation of the Chinese economic situation emerges:

There’s really no way to spin this as confirmation of a world doing really well, at least not honestly. Before 2020, retail sales had never been less than 7% except on one technical occasion almost twenty years ago; the rate had only recently dropped below 8% back in 2019 as the “strong” Chinese economy of media lore had been similarly in trouble.

Yet, somehow now it can’t even manage that much even in a year following such a huge contraction (in other words, there’s been no make-up whatsoever for an entire year of lost activity!)

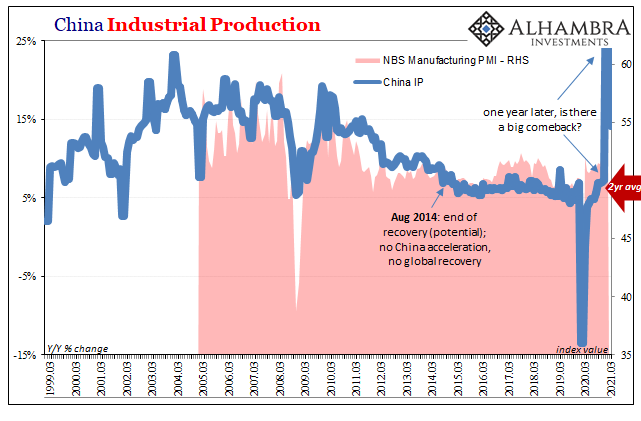

And this is true throughout all of the latest estimates on China’s condition. Next up on the list (of their Big 3) is Industrial Production which had actually flashed some acceleration in the January-February combined period. Not March.

The year-over-year increase for the first two months of 2021 had been 35.1%, but even with substantial base effects the rate fell way down to just 14.1% March 2021 compared to March 2020. Thus, the more appropriate 2-year comparison was instead 6.8% (average rate) according to the NBS and just 6.2% properly compounded.

Six point two is near the bottom of the previous 5-year long range for IP that had represented a Chinese economy struggling with a sustained lack of growth from the rest of the global regime. It was this level of weakened advance which had convinced Xi Jinping in 2017 (19th Party Congress) to abandon the character of Socialism with Chinese Characteristics that had existed since Deng.

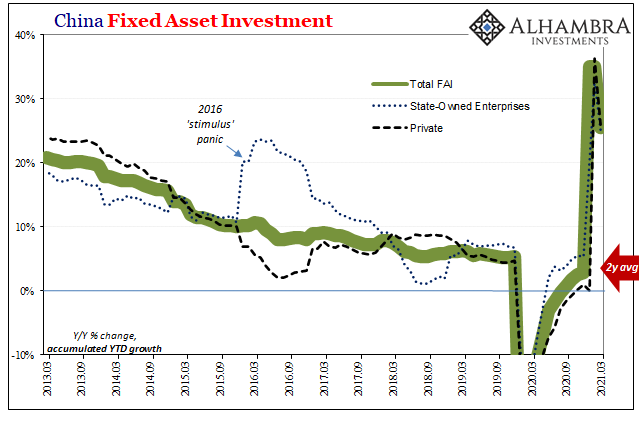

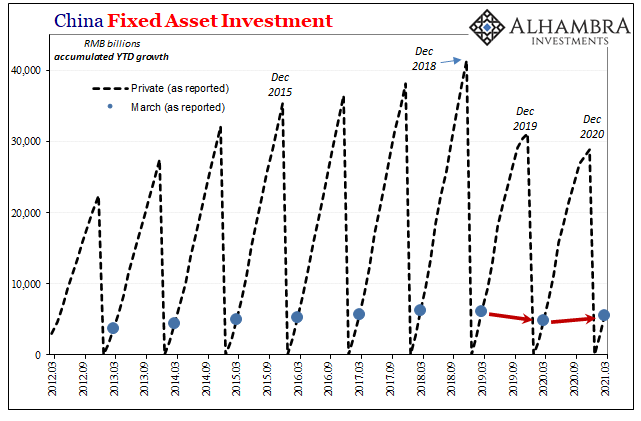

The secret, so to speak, of the Deng version of China’s governing Communist doctrine had been fixed asset investment, or FAI. Before the so-called ghost cities began showing up (which was nothing more than a slowing economy increasing the amount of time new facilities and housing was unused or unoccupied relative to before 2010), much of the baseline growth potential was seeded by real economy investment, public and private.

For the month of March 2021, total FAI was up a reported 25.6% but that was boosted by a much larger base effect being compared to March 2020 when in fixed asset investment the decline had been nearly as bad as the January-February trough. Rolling instead with the 2-year comparison, the NBS admitted its average was just 2.9% (we can’t do a legitimate compound rate because the prior year numbers aren’t comparable).

Less than 3% in FAI is, well, you get the point:

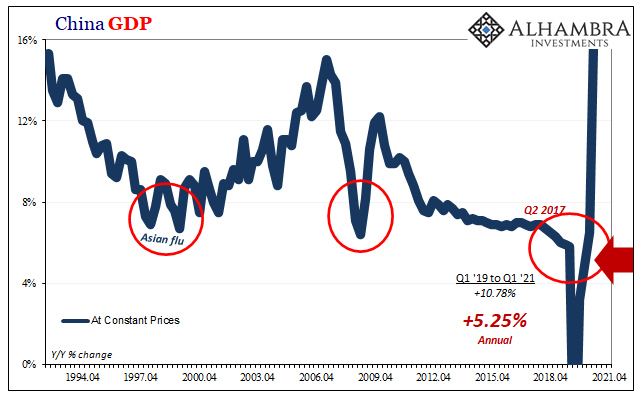

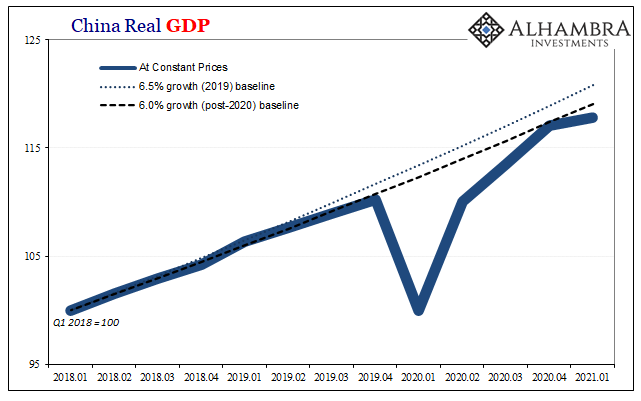

The NBS also calculated first quarter GDP, which pretty much leaves no doubt as to the real situation. Year-over-year, another huge number – best on record. At constant prices (real), total estimated economic output was 18.3% more in Q1 2021 than Q1 2020.

But, when compared to Q4 2020 on a like, quarterly basis (adjusted figures), the increase was incredibly small suggesting that the Chinese economy stumbled badly to begin this year (blamed on COVID, obviously). The quarterly rate was instead just 0.6%, nearly flat, compared to 3.2% Q4 over Q3 and 3.1% Q3 over Q2 ’20.

As a consequence, the 2-year change for the first three months of this year was a compounded 5.2%, which is below the “above 6%” Li Keqiang had previously announced as the directed growth target for the calendar year (suggesting that the government expects only a modest pickup over the coming quarters, but not much more).

All the data in China uniformly describes a rebound which is pulling at the same general trendline as has been the case for more than half a decade, a declining trendline.

That means 2020 and 2021 together are already booked to be a two-year period with the worst possible numbers since Deng’s time. And it won’t even be close.

Furthermore, China is fine with this; they’ve already installed their social credit system of control and have ordered up military-grade levels of secret police (and tactics now tested in places like Hong Kong).

It’s everyone else who will “unexpectedly” suffer when the recovery predictably falters yet again; the questioning turns more toward “when.”

These may be gargantuan annual changes, but in no way do they represent something special brewing in the global recovery. No, it’s the exact opposite and every single one of these Chinese estimates absolutely confirms this.

Unexpected to our own Economists and the mainstream media, Communist Party leaders over there have already admitted, outright stated, how even at these low (not high nor anywhere close to robust) levels they believe the Chinese economy has already returned to its potential state; as all these economic accounts shown here indicate. That potential state just isn’t what’s being imagined everywhere else.

With the obvious exception of the global bond market.

Touting clearly suspicious figures with naked, purposeful hyperbole really isn’t the best opening round to Bonds v. Economists 5, at least not for the challenger yet to land a single blow despite fourteen years of this same contest. Then again, when you’ve been beaten soundly for so long, why not just come out throwing wild haymakers and just hope something lands. Given Feb 24-26, they might be in for it anyway.

Stay In Touch