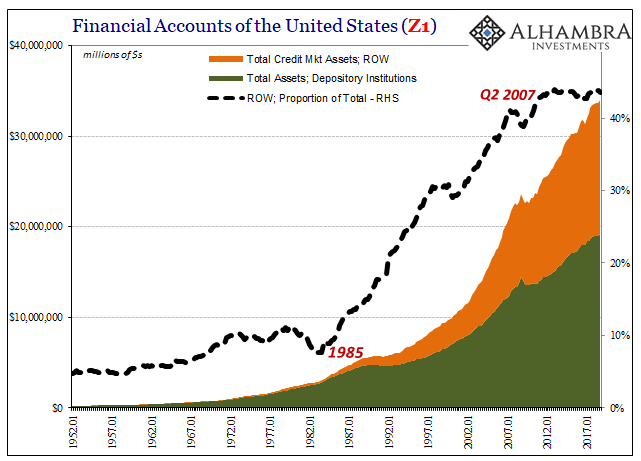

During the first quarter of 2008, as Bear Stearns teetered on the edge of illiquidity, foreign holders of US$ financial assets contributed $9.3 trillion to US credit markets. According to the Fed’s Z1, the Financial Accounts of the United States, it tells us that’s the amount they held in possession from outside the American geographical boundary. Considering at the same time US depository institutions reported a total of $13.4 trillion in all assets, overseas agents represented a huge chunk (an astounding 40% of this combined total) of bank-driven domestic credit.

It wasn’t always this way. There had always been a somewhat robust financial participation originating elsewhere (from the US perspective) throughout the country’s history. In terms of these modern statistics, it was steady at about 5 or 6% throughout the fifties and early to mid-sixties. By the time the Great Inflation sparked, right around when the eurodollar system fully matured, suddenly foreign sources were all over domestic financial markets.

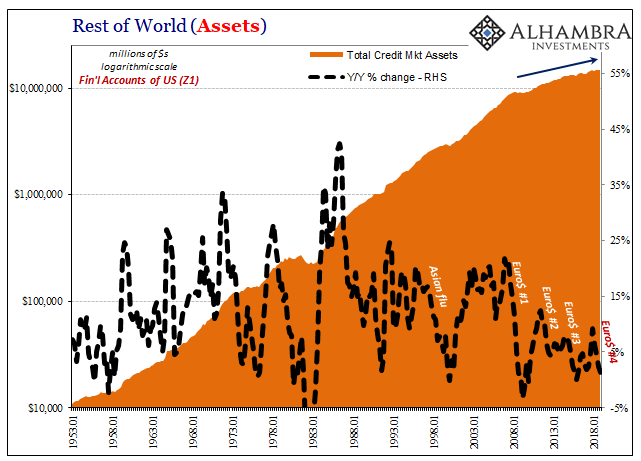

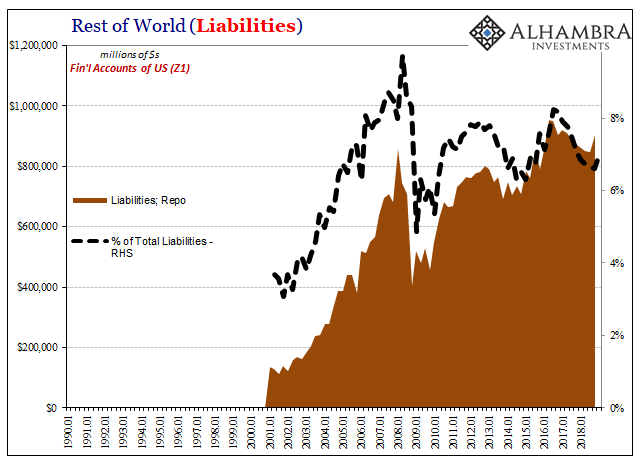

The proportion hit 10% as early as 1972, the eurodollar fully supplanting Bretton Woods long before then, on 30% annual growth. It was still ~10% by 1985, domestic credit expansion at that time matching this foreign influx, when ROW really took off (Rest of World, in Z1 categorization). Eighty-five was the year eurodollar futures (introduced in 1981) and interest rate swaps markets were standardized (ISDA) on what was the old Chicago Board of Trade.

Throughout the nineties, especially when domestic credit sources were struggling with the S&L crisis, ROW was there to pick up the slack (and then some). As late as Q2 2007, growth in this overseas credit influence was still better than 20%.

Why were there so many dollar swaps offered by the Federal Reserve during the depths of the 2008 crisis? Why were European authorities nationalizing foreign banks because of what seemed to be US subprime mortgages? ROW.

As the eurodollar system matured and expanded over the last four decades of the 20th century, it brought with it an outsized contribution to the US domestic system, too. This weird global reserve currency didn’t just build modern China; and now these eurodollar events are not just a plague on global trade and foreign economies. A lot of what ends up inside the United States is sourced from outside of it – in dollars.

This offshore money won’t show up anywhere in the official literature, but that doesn’t mean it doesn’t exist. Practically no one has heard of the eurodollar, but it’s been out there all this time totally, completely rewriting the lived history of the world. Good, or seemingly so, and bad.

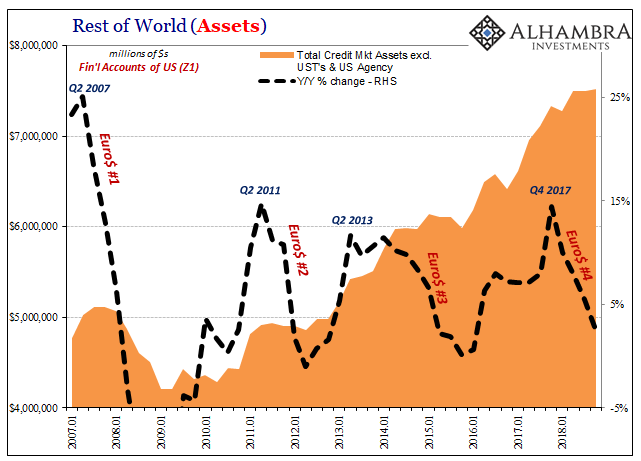

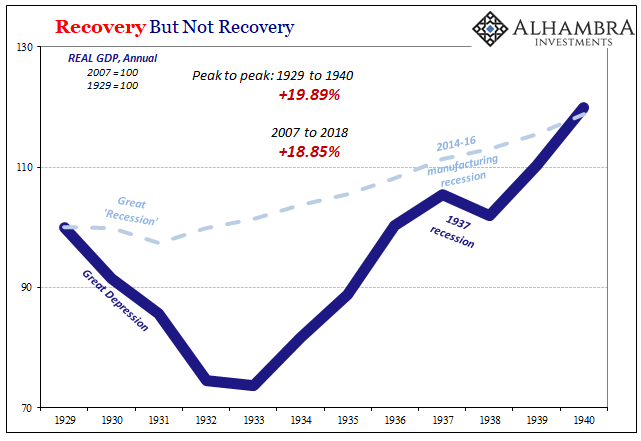

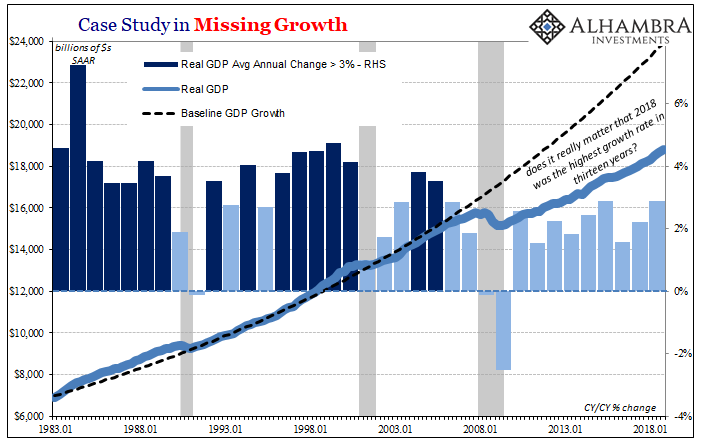

You begin to see the problem when you plot it by logarithmic scale. ROW has still been adding to its stockpile of US credit market assets over the last eleven years (especially UST’s before 2014), but not anywhere close to the same rate as before. We live in a non-linear world, which simply means that rate of change is everything; if 15% growth was “normal” and 5% expansion permanently takes its place, that’s very real contraction.

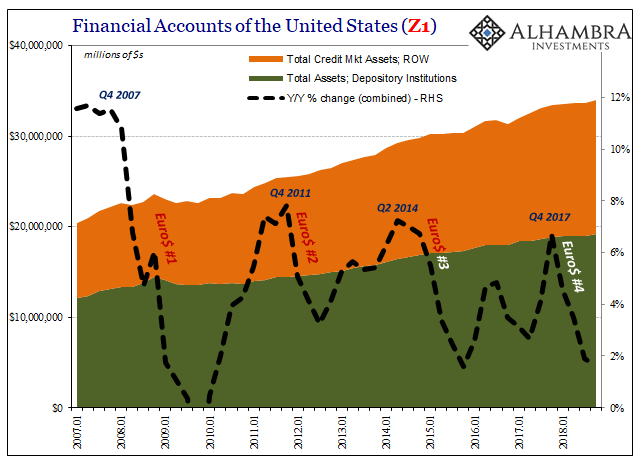

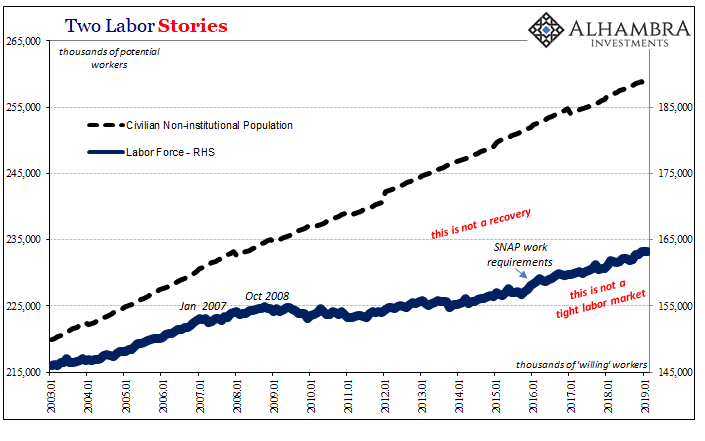

As is the perfectly clear ups and downs that are the reason there is a lid on monetary therefore credit expansion (both onshore as well as offshore). The entire global system (because it is a global system) can never get going far and fast enough before some major irregularity sets it back to zero again. These are the eurodollar squeezes showing up in credit, numbers one through now four.

At the margins, what counts as money offshore in this entirely separate monetary ecosystem isn’t what they write up in standard material. The M’s were obsolete by the seventies, this stuff the beginnings of that era’s “missing money.” Markets like repo and what used to be unsecured, all interbank lending and borrowing (including FX footnote dollars) that comes out like monetary (liquidity) growth supporting credit growth supporting economic growth…or not.

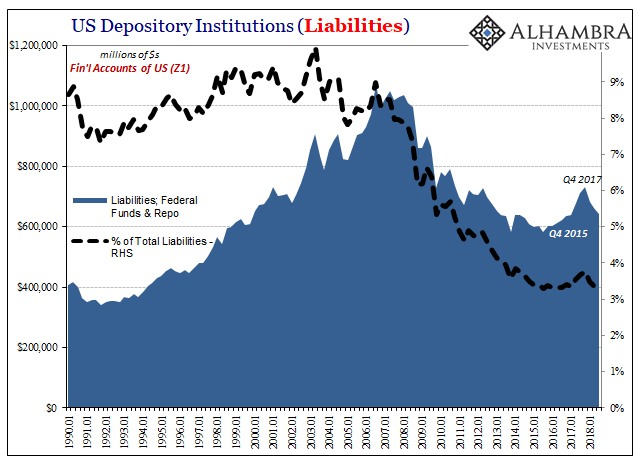

The wholesale problem has inundated the domestic part of the system as well as what lies offshore. I’m very much oversimplifying here, but the outlines of the big issue (balance sheet capacity) are pretty clear just using repo liabilities on both ends.

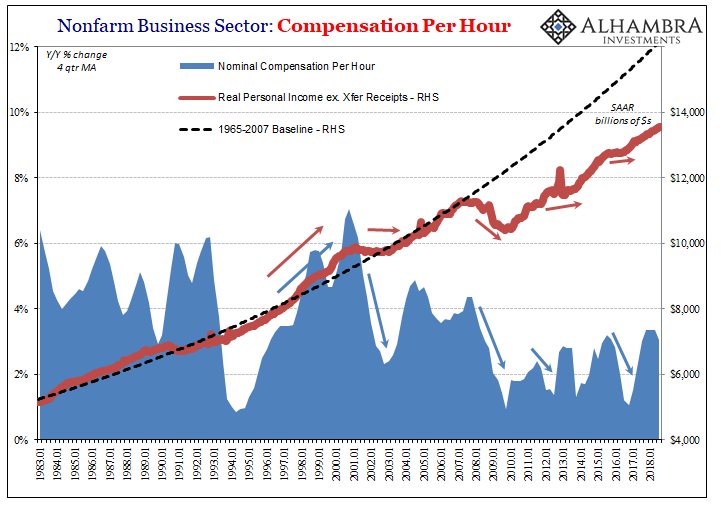

Wholesale, interbank money or liquidity just isn’t manufactured the way it used to be. The massive, multi-decade credit expansion up until 2007 required this “other” monetary system to float and support it. Without it, at the margins things just don’t get done like they used to. The Fed can do all the QE’s it wants, but to what end? Not monetary, nor credit.

This means the global system is far more susceptible to these kinds of reverses that have intermittently overwhelmed it; interspersed with periods of reflation that are more sentimental than monetary (Richard Fisher’s monetary head fake).

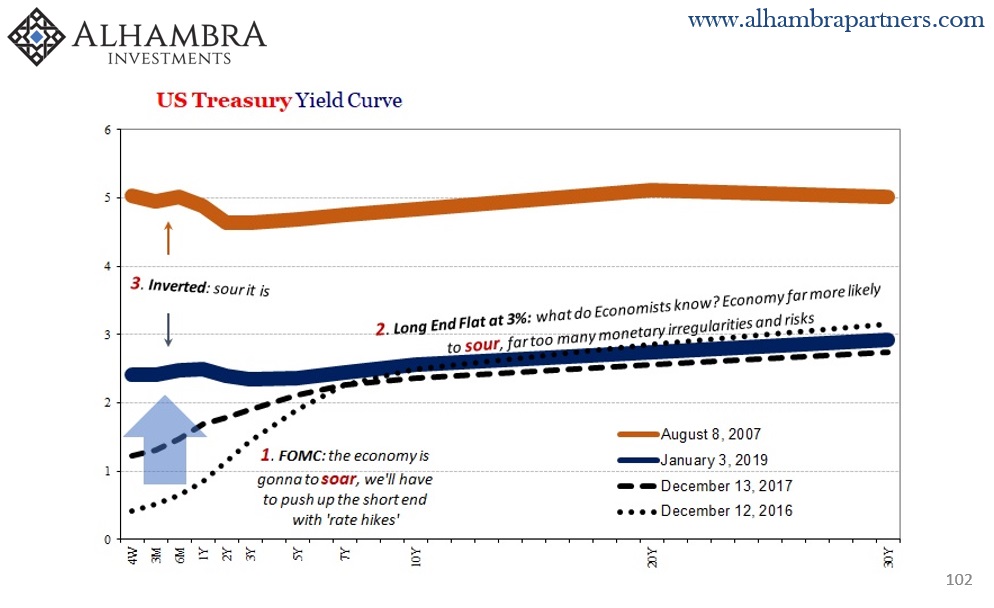

The net result is classic tight money symptoms, including the mainstream’s inability to come to terms with its own textbook (missing the chapter on modern, global interbank money offshore). Here’s Milton Friedman in 1967:

These subsequent effects explain why every attempt to keep interest rates at a low level has forced the monetary authority to engage in successively larger and larger open market purchases. They explain why, historically, high and rising nominal interest rates have been associated with rapid growth in the quantity of money, as in Brazil or Chile or in the United States in recent years [early part of the Great Inflation], and why low and falling interest rates have been associated with slow growth in the quantity of money, as in Switzerland now or in the United States from 1929 to 1933. As an empirical matter, low interest rates are a sign that monetary policy has been tight-in the sense that the quantity of money has grown slowly; high interest rates are a sign that monetary policy has been easy-in the sense that the quantity of money has grown rapidly. The broadest facts of experience run in precisely the opposite direction from that which the financial community and academic economists have all generally taken for granted. [emphasis added]

Money and credit need not be contracting in absolute terms to register the same effects as Keynes talked about in demanding the world understand, and do everything to avoid, deflation. Non-linearity counts. Growing more slowly ends up as the same thing. Growing a lot more slowly is real trouble.

What do US banks, who are once again piling into the safest, most liquid assets, really fear? Expressing such obvious liquidity preferences need not be due to a 1929-33 style collapse. The credit “growth” of the past eleven years explains enough. Eurodollar decay. Growth that just isn’t growth.

Stay In Touch