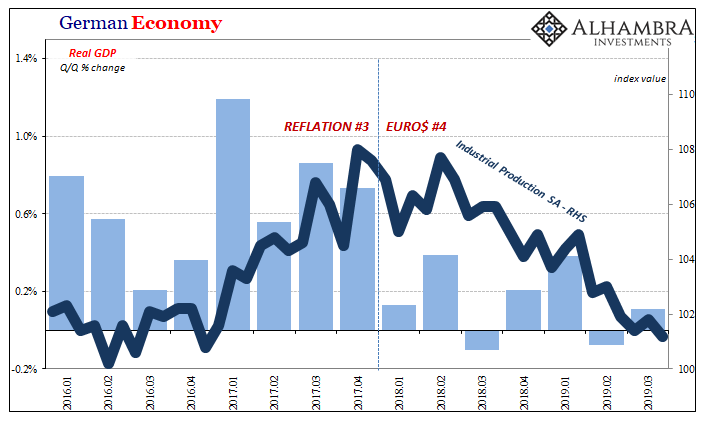

The Germans managed to do it, to avoid meeting the dreaded technical definition of recession. While not a meaningful one, conventional wisdom assigns the classification to any economy which features two straight quarters of declining output typically measured by real GDP. Germany’s was slightly negative in Q2 with most expectations for a repeat in Q3.

Instead, deStatis reported last week a rate which just barely managed to inch back above zero. At +0.1%, unless revised lower in the coming months it will not meet the informal standard.

Because Germany keeps straddling the line between recession fears and avoiding recession conventions, the confusion will only linger for at least another three months. As such:

In some sense, this is the ‘worst’ of both worlds for markets. Today’s data confirm that the German economy has now stalled, but the headlines are probably not dire enough to prompt an immediate and aggressive fiscal response from Berlin.

The typical quote from the typical credentialed Economist who declines to add any insight. If growth has stalled, shouldn’t that mean…something? The conventional view has finally come around to at least that much, but now struggles to make any sense of it.

What Dr. Economist is getting at is the typical mainstream stance: the economy is either booming or it is in recession. One or the other. If it isn’t the latter, then, hooray? He quite rightly surmises how government and official responses will quite wrongly be assured by the lack of Germany meeting the technical definition. Believing that, they’ll wait for recession to be confirmed before the “aggressive fiscal response.”

Not that it will do any good, but the reason they’ll wait is simply denial. Germany has been struggling for nearly two years – and no recession yet. Therefore, while the economy may have stalled it seems to everyone like remarkable strength and resilience. Must be a good thing that it hasn’t been worse.

All signs, however, continue to point to Berlin getting its wish, meaning clarity. The economic direction continues to trend downward which right now simply means more of this confounding instability.

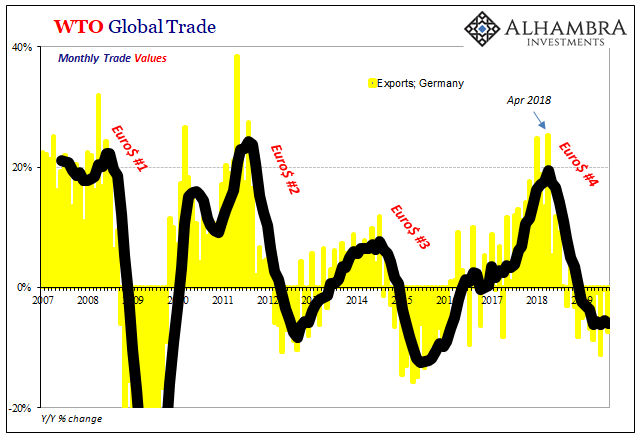

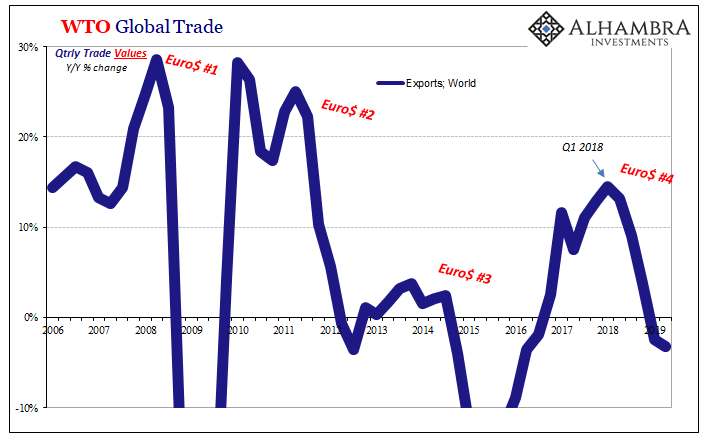

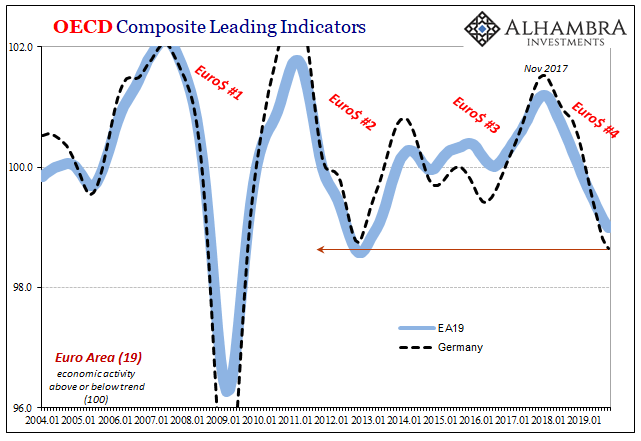

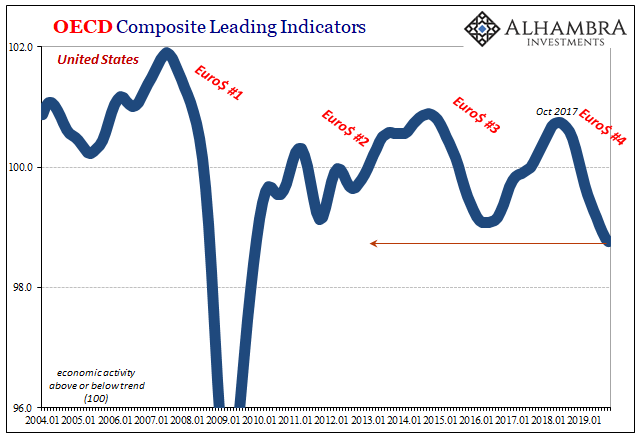

Germany is being plagued by the same factor plaguing everyone else. Not just instability but also where: global trade. What was supposed to be globally synchronized growth very quickly reformed into globally synchronized downturn – all at the same time Western central bankers remained unshakably faithful to the former.

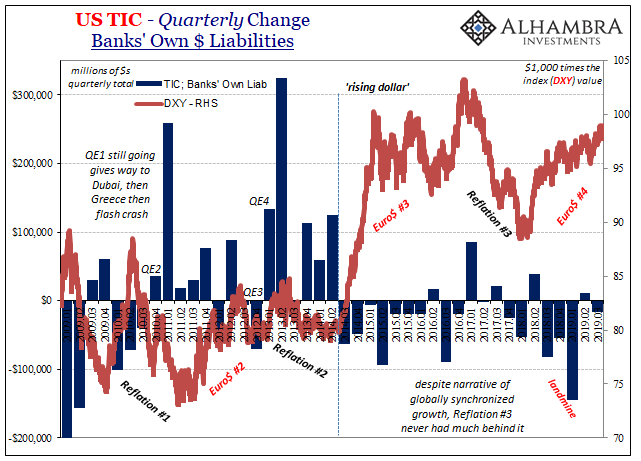

As trade goes, economies follow along. As the dollar goes, that’s trade.

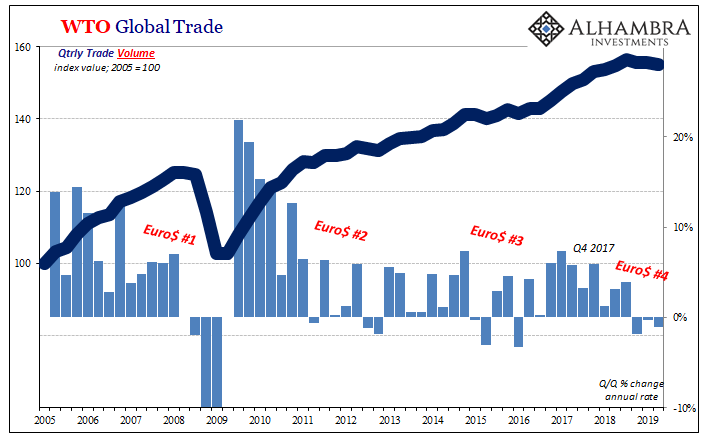

That’s the bad news. If Germany has been brought to recession’s door by faltering trade (especially in capital goods), then the WTO today suggests there’s no end yet in sight for the already lengthy negative trend.

Goods trade has stalled in recent months, as evidenced by declining year-on-year growth in the volume of world merchandise trade…The latest barometer reading suggests that goods trade will likely remain below trend in the third quarter and into the fourth quarter.

Trade values (first chart above), which take into account currency fluctuations related to the dollar, are already declining year-over-year. Trade volumes in all likelihood will be shown to have been negative year-over-year in Q3 when the initial data is released in the coming weeks. If that is the case, it will be the first annual decline in total trade volume since the Great “Recession.”

As it is through only Q2, seasonally-adjusted the WTO trade volume index has been down (Q/Q) in each of the last three quarters. That’s already is a first dating back to 2009.

In other words, the global trade environment is already the weakest in ten years and it appears set to become weaker. Despite that, the fact that there haven’t been outright recessions in a good many places like and besides Germany isn’t cause for celebration. After all, the trade negatives aren’t huge, either.

Rather, what’s bleak about the external environment to this point is more so just how frustratingly durable it has been going slightly backward. Prolonged weakness rather than any serious depth to it. Again, that’s not reassuring, it is instead heightened anxiety about what happens when some critical threshold is finally met – if or when length finally meets depth.

That’s why you continue to see leading and forward-looking indicators inching lower and lower, looking much more like 2009 (though not quite all that way that far). Right now, it’s not the actual downside that matters but the building downside risks.

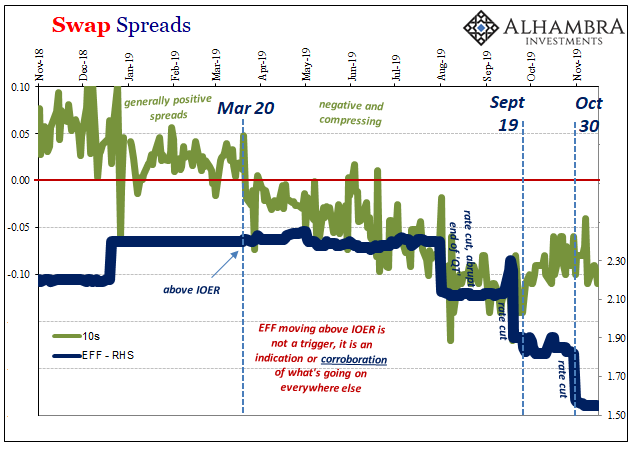

Risks that are being met by what? Rumors of trade deals, more QE, and the same sort of rate cuts that never work (never mind 2008, how many rate cuts did Greenspan’s Fed do that didn’t keep the US economy out of the dot-com recession?) At least nobody is talking anymore about how fed funds at 240 bps must be the reason for all this mess.

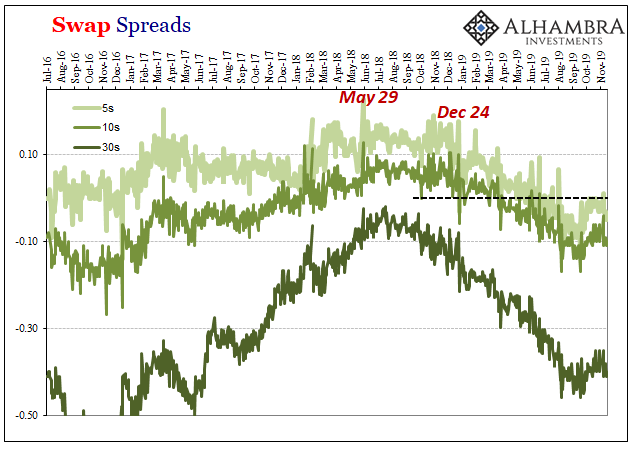

In other words, all of these things, from Germany’s perpetual flirtation with technical recessions to the bond market to the stubborn, unending drag of global trade, they all keep saying that “it” hasn’t happened yet. The world has been pulled in the direction of “it” for going on two years and: 1. No one really knows what or why that is; 2. We are only inching closer to finding out.

When it comes to recessions and the like, nobody but the eurodollar system has any sort of patience.

What applies is the same question as I had asked beginning in June 2018 when the eurodollar curve first inverted; what will make Jay Powell turn around 180 degrees and start cutting rates at exactly the time he was so sure he’d be raising them aggressively? Now that he’s done it, three times, we still don’t know exactly what “it” is that has made him do it, and, don’t kid yourself, neither does he, but we can reasonably assume it isn’t a mid-cycle adjustment given the direction of where everything is still heading.

Stay In Touch