From October 2000 to July 2001, the Treasury Department conducted a special survey of users of its Treasury International Capital (TIC) data. Nearly two decades ago, it had become apparent (to some) just how important international dollar flows were to the overall economic and financial landscape. And not just those of the United States.

TIC was created ostensibly to aid in balance of payments accounting; the old idea that money was (nearly) fixed so the only thing which mattered was measuring where it went. This left an early 20th century bias in it right up into the 21st century.

Because of this, most complaints about TIC in the first years of the new millennium dealt with this defect.

One user noted that due to the transactor-based system, holdings estimates for the UK are huge and for some other countries are negative, severely limiting the usefulness of the data. Another user noted the constraints the unreliability of the geographic data places on understanding the sources of U.S. external financing.

The latter grievance was posted (I am guessing) with regard to specifically US external financing – national balance of payments. I doubt the protester had come to realize how “understanding the sources of US external financing” by then already meant a whole lot more than that.

TIC is invaluable. There are so very few data series let alone good ones relating to cross border financial relationships and flows. It wasn’t meant to do the heavy lifting outlining and detailing a global reserve system the official world doesn’t realize is there. Quite by accident, the dataset ends up measuring the things we desperately want to know about in this offshore, shadowy monetary realm.

It is understandably imperfect.

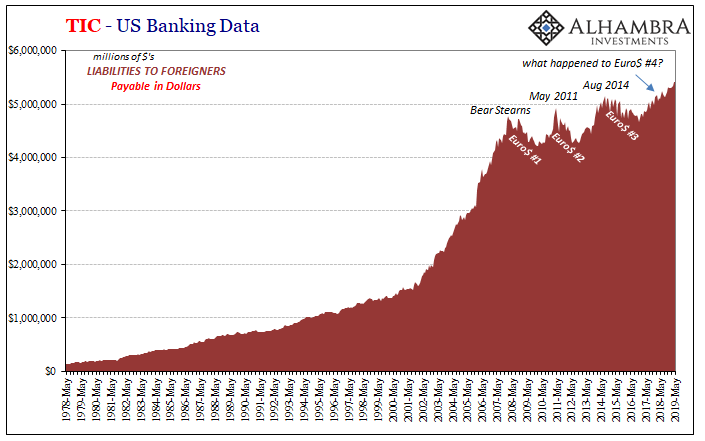

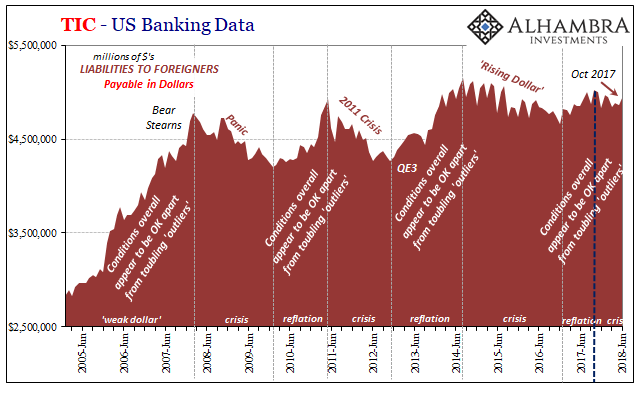

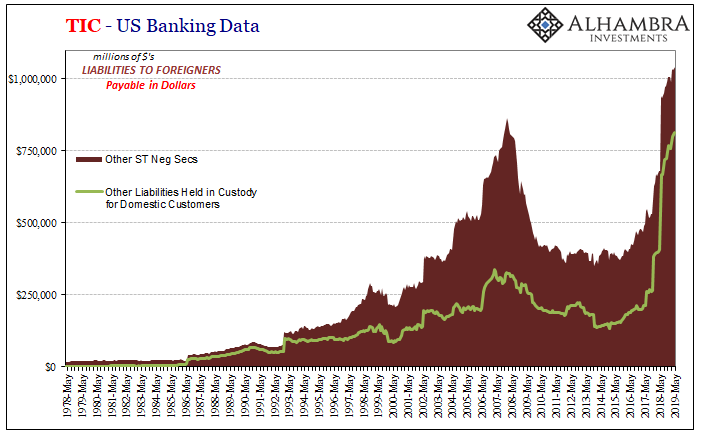

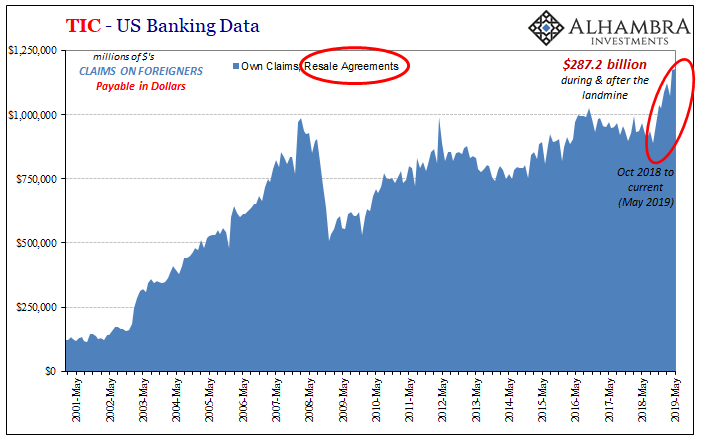

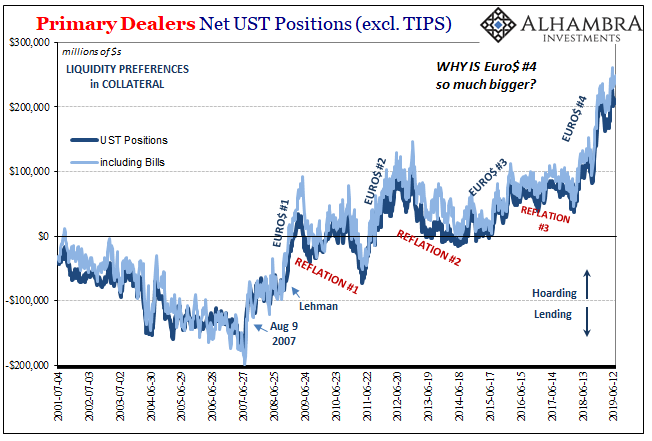

For all its faults, in very general terms TIC provides solid evidence for the eurodollar breakdown. Not just that the system had broken down twelve years ago, but the data also shows us exactly what market figures and prices do – how it has remained broken, these ups and downs or mini-cycles moving only from monetary squeeze to reflation and back again.

The Global Financial Crisis wasn’t a one-off, it was a repeater (to varying degrees).

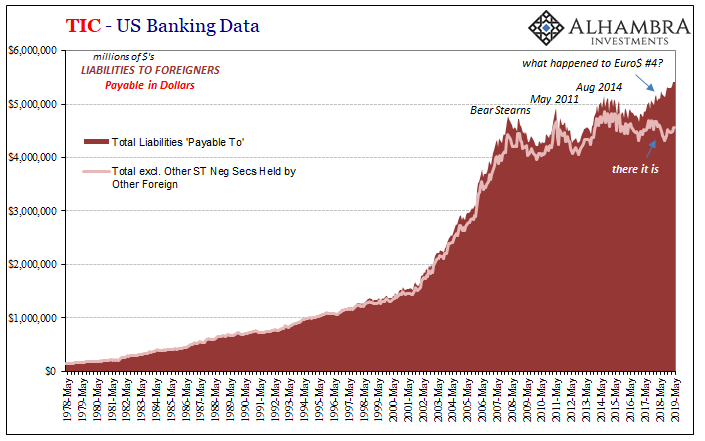

It was the red series (US bank liabilities to foreigners payable in dollars; ostensibly US banks borrowing “dollars” from foreigners of all types) which most closely resembled the market data in their narrow swings back and forth. All except the current one – number four – that’s suddenly missing.

I write suddenly missing because up until the middle of last year Euro$ #4 was pretty clear in the red just like it was becoming clear in most markets. From the dollar to UST yields (May 29, in particular), the next squeeze in the series was right then an open and visible issue.

Here’s what it looked like up through the data for May 2018 (released last July):

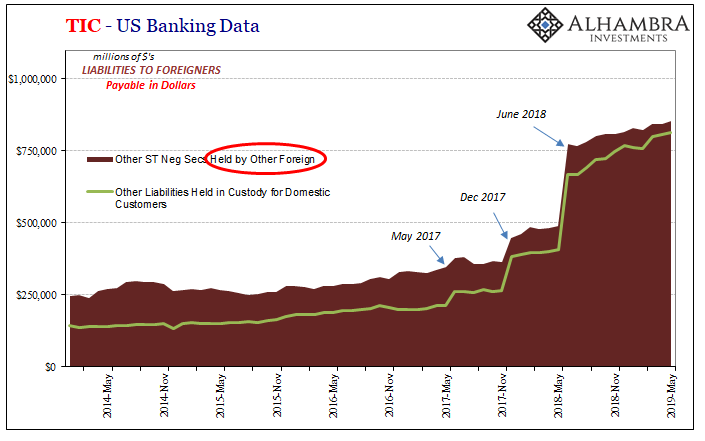

Starting with estimates for the month of June, however, there were several revisions alongside what the Treasury Department claimed was a discontinuity.

Improved reporting of collateralized loan obligations (CLOs).

A peculiar one, peculiarly timed in the immediate aftermath of May 29. And that wasn’t the full of it, either. These “other” securities happened to be owed (US bank liabilities) to “other” foreign entities – neither banks nor central banks. The nonbank sector. I covered this “aberration” when it first arrived, only it didn’t seem then, and still doesn’t seem now, to be a discontinuity. At least not entirely.

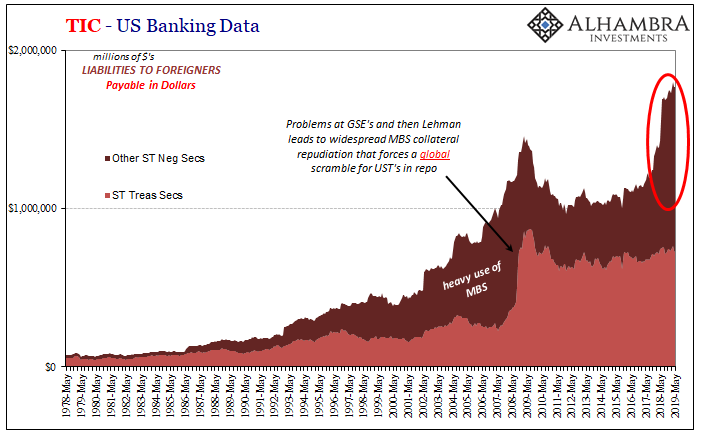

Taking account of this one data line, the rest of it falls into place. So, in the red series Euro$ #4 disappears into a bursting sea of CLO’s. Not just any, however, but more peculiar still there is a parallel TIC entry in another “other.” Custody liabilities.

Treasury talks of data collection improvement beginning with the data for the month of June 2018. What about the prior December? There was and remains no mention of other data improvements even though the June spike isn’t the only spike. There was a large one in the final month of 2017, right at the same time a lot of Euro$ #4 stuff first started to leave its mark.

Those aren’t the only clues: there’s one more.

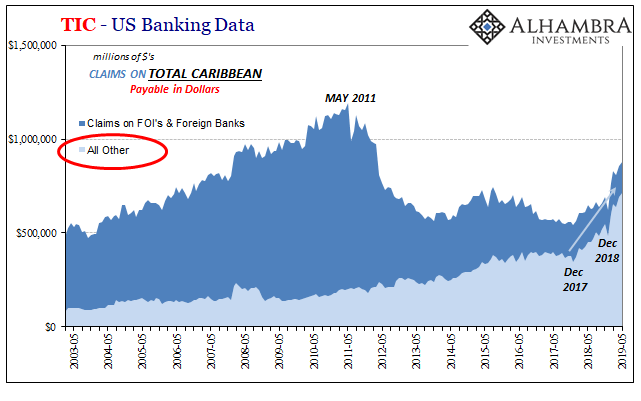

The impact [discontinuity] is noticeable for the Cayman Islands.

Sure enough, when you look at the TIC breakdown by country, there’s been a sea change in Caribbean behavior almost all of it centered around the Caymans (thanks Offshore Emil). Going back to May 2011, the very start of the permanent break in Euro$ #2, one of the most important redistribution points in the global eurodollar system had decided to get out of the dollar redistribution business.

It was a categorical change in activity. Therefore, note both the timing (December 2017) and the recipient (All Other) for when it changed back – or maybe changed into something more different still.

OK, that’s a whole lot to unpack in such a short space. Let’s start by taking things literally, just as they are described by TIC. For whatever reason(s), there’s been a truly massive increase in US bank liabilities in the form of other securities (CLO’s) belonging to non-bank foreign agents. At the very same time, for whatever reason(s), there’s been a slightly larger increase in US bank liabilities being held in custody for domestic customers.

And much if not most of whatever’s going on is being run through the Cayman Islands.

We aren’t left with too many options to consider. One would be US-based hedge and/or mutual funds bulking up on the assets of wealthy tax shelterers speculating wildly about perhaps EM corporate junk (CLO’s in dollars), buying up each and every syndicated tranche they can find and using specific Cayman Island subs for domestic US banks as their agent acting on their behalf (custody, too).

Since that would amount to a massive “capital flow” into the rest of the world, a generally very positive thing for the rest of the word, particularly EM’s, it doesn’t fit the situation one would honestly describe around the globe beginning around, say, December 2017.

If instead we start to think about all those “others”, other intriguing possibilities do line up. Custody. CLO’s. Caymans. Domestic and foreign nonbanks.

Shadow repo transformation? A gigantic collateral call?

For one thing, the timing. I wrote last November about what seemed to have begun the around the end of the year before:

Dealers, any who may have accepted them [Eurobond junk] at the start of the trilateral repo described above would’ve been forced to immediately and substantially alter the terms of the collateral transformation. I might have pledged previously $110 in Argentinian Eurobonds to get $100 in UST’s for $99 in repo, now I’ve got to pledge $120 in Eurobonds for the same funding (these numbers are just for illustration purposes).

Or sell a significant fraction of them so as to get back to a matched dollar book.

Two things we know happened at that point beginning December 2017: Eurobond prices plunged and now, thanks to TIC, we can see that custody of CLO liabilities jumped (before jumping again in June 2018). In other words, both of the things I described above.

That only leaves the addition of them; as in, why do they suddenly show up as an increase during what surely has been another dollar shortage? The key, I believe, is found in all those “others.” As strange as it may seem, there’s shadow money which TIC may capture incidentally, and then there’s shadow shadow money (things not unlike footnote dollars) in which pretty much nothing does (datawise; we still can surmise and speculate off market prices).

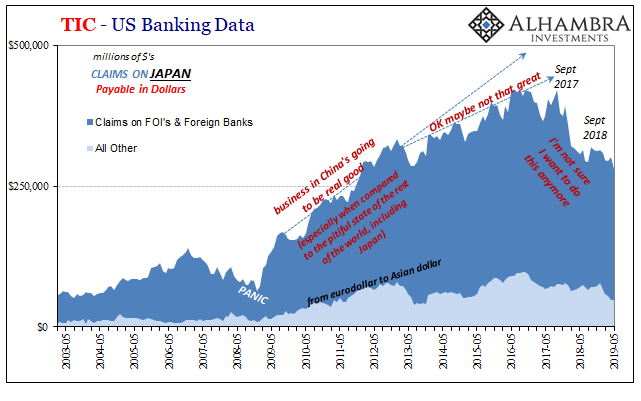

TIC, like anything created by Economists, is more interested in the financial system (meaning banks, not nonbanks) that we can see and even then narrowed to what happens only when something touches US banks. If, say, a nonbank fund operating out of Zurich were to have repo-ed Eurobond junk for dollar funding from a Japanese bank, maybe transforming that junk into UST’s somewhere along the way, does that show up anywhere?

It does in the market pricing, but it isn’t getting recorded by TIC or anything else. If, however, the Japanese bank decides it doesn’t want to be involved redistributing dollars especially on junk EM CLO Eurobond collateral, especially in the aftermath of the Chinese Communists announcing there would be no economic growth in the world, where might that Zurich nonbank go for recourse?

It can’t go to the Fed nor ECB (despite dollar swap lines). A US bank operating through the Caymans might be willing to step in as a last resort, but only if the collateral terms are changed in its favor (higher haircuts and greater spreads). And the US bank may have no other choice to provide that repo if it was the one who transformed the collateral in the first place (the lesser of two evils, or least-worst option).

Not only might that be a problem for this one fund, it could trigger or contribute to what was already a systemic response (run on collateral, essentially) if it isn’t in isolation and the terms of the transaction merely aligned with broader market positions (confirming collateral suspicion, so to speak).

What if that Zurich nonbank was actually the trading arm and domicile sponsored by a domestic hedge fund? The obligations (assets) get shifted around to take advantage of what might be a narrowing list of funding opportunities (move it closer to home, so to speak). Especially if there is an FX or swap component (which you can bet there probably was, though I won’t get into that here).

What could have been shadow shadow funding not picked up by anything decays into shadow funding that does. These CLO’s didn’t just show up from nowhere; they likely existed out there in one of the many offshore spaces that doesn’t get mapped out by any data collection effort. The fact that they show up now, when they show up, potentially indicates something has changed which has made them show up.

That’s ultimately the possibility which interests us; and perhaps frightens anyone operating in these shadows and shadow shadows.

Repeating what is now a very old TIC complaint:

Another user noted the constraints the unreliability of the geographic data places on understanding the sources of U.S. external financing.

Admittedly, that’s a lot of filling in for what remain as substantial gaps, my own view of incomplete figures and data. It doesn’t prove what’s going on so much as describe the context behind what we’ve been observing since December 2017.

You are free to draw your own conclusions, of course, including what might have been an epic hedge fund debt buying binge that somehow has left overseas destinations to “sell UST’s” (the rest of the latest TIC) and complain about dollar shortages.

This doesn’t discount the data discontinuity, either. The “improved reporting of collateralized loan obligations” doesn’t change the direction or our interpretation, it merely clouds the amounts by which these things might be taking place. In other words, as seen in December 2017 as well as following June 2018, along with the Cayman and Caribbean statistics, this thing, whatever it is, was going on to a substantial degree before the data collection on CLO’s was “improved.”

For one thing, why at some point just prior to June 2018 did it appear necessary for Treasury to expand the data collection with regard to CLO’s? This isn’t a conspiracy; oftentimes, that’s how these things happen especially when the government gets involved. Hey, I’m seeing a lot of talk about Cayman Islands CLO’s, maybe we should take another, closer look?

The shadow shadow stuff behind the Eurobond binge decays into a shadow eurodollar problem that accidentally gets noticed. Even if we can’t say for sure by how much, to me it’s evidence of the same basic problem.

What problem? A eurodollar system experiencing its fourth, not first, setback. Each time it generally follows the same pattern. Cautious optimism spreads in the aftermath of the last one, aided and supported by bewildering belief in central bankers with and without monetary policies that never actually work. Reflation #3 was the work of the ridiculous “globally synchronized growth” that perpetuated a collateral process [EM Eurobonds] as stupid as subprime MBS. AIG nearly failed a decade ago not because of CDS written against “toxic waste” but because it was transforming collateral.

Again. I’ve written recently how repo is quite demonstrably the lender-of-last resort in the world. Rather than being the monetary system’s salvation, this is its original sin. Collateral was the key weakness in turning the first one in 2008 into what it became. And collateral is a big issue again even before we get to TIC.

What might that say about at least the monetary risks being faced by number four, starting in collateral? The “bond market” is spooked about something, and repo is right in the middle. Imprecise and accidental, something something bottleneck.

Stay In Touch