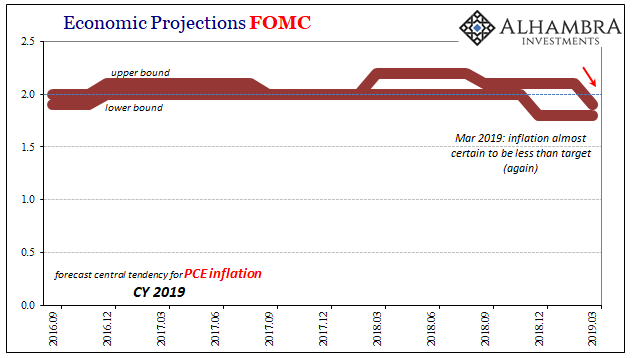

Officials at the Federal Reserve have already announced they are undertaking an exhaustive review of their policies. Small wonder, the way things are turning out in 2019. It’s another year where they’ll have to apologize for so much over-optimism. Inflation hysteria seems like such a very long time ago, and so brief of a reprieve.

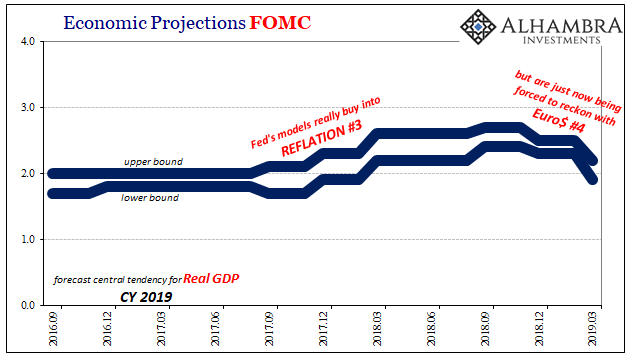

What should really bother central bank reviewers is why their econometric models are so susceptible to these ups and downs. If they are at all accurate, they wouldn’t be; they’d see them on the way up for what they are, and forecast the way down. For instance, as inflation hysteria built to its peak, the statistical processes really bought into it. Forecasts were raised, substantially, because they are just that subjective.

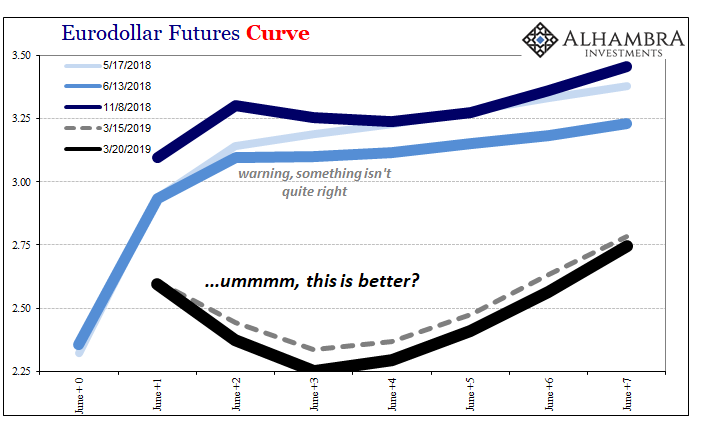

Math is supposed to be objective, but time and again these eurodollar events reveal the equations to be of little help; complete confirmation bias. When things start to go in the right direction, reflation, that direction is attributed to skillful monetary policies and then extrapolated far into the future.

Recovery is declared. Prematurely, every single time.

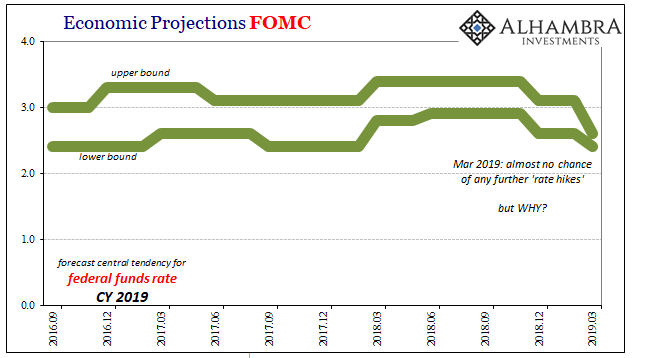

And then, for reasons the models don’t foresee, they don’t actually model the monetary system, poof, it’s gone again. Therefore, what actually moves these projections isn’t monetary policy or a firm grasp of the economy but effective monetary conditions no one bothers to reckon. Only, officials aren’t aware because by being slavish about their math they go back to busily reconfiguring their R* as if it matters.

Why in 2019 has the FOMC turned so far against their strong economy in 2018? The models have begun to discover the contours of Euro$ #4. When just the leading edges finally show up on ferbus, as I wrote earlier, it’s already a big problem.

The (rationally priced) bond market says this ain’t over, either. It’s just getting started.

Stay In Touch