What is most disheartening about the current political formulation on economics is the bipartisan acceptance of “inflation.” It comes from both the left and the right. That is in full part due to the orthodoxy of the economic “profession.” Despite being drastically wrong about pretty much everything for most of the past few decades (never saw a bubble they didn’t like, if they saw it at all) the mainstream fails to discredit the practice.

Inevitably that turns to prescriptions to assuage ongoing economic malaise. Again and again the political class accepts without question the “need” for economic “aid” more than five full years from its first application in the form of FOMC pseudo-precision. While there were some noises of disgruntled Republicans, nothing came close to anything less than a rubber stamp on Janet Yellen’s nomination.

Ramesh Ponnuru, editor at the erstwhile conservative magazine National Review, confirms in a Bloomberg column that the mainstream of economics should be the only stream. “Hard money” politics is loser politics; inflation is embraceable. In listing three reasons why that is so, he begins with:

The first is that it will cost them elite support. Presidential candidates generally like having a lot of mainstream economists endorse them.

At some point, the “seal of approval” from mainstream economists will be worth Ben Bernanke’s prediction record. Both the current Chairman and his successor are died-in-the-wool, orthodox economists of the highest persuasion. And the economy is still running through bubbles while other mainstream economists are convoluting themselves as to why that is, and why the global economy is just so damn stubborn to resist their best ideas. This is not forward thinking, it is an idealization of when Alan Greenspan was still a genius. Ponnuru doesn’t seem to have gotten the message that the public, like the polling cited in his own article, senses something dreadfully amiss at the academy.

But more than that, these elitists don’t even understand that which they purport to invalidate. The key sentence in the next quote is the last sentence:

In the short run, hard-money politics could benefit Republicans. Few voters have strong views about monetary policy, and those who do are generally followers of former Representative Ron Paul, a gold man. A sustained political campaign also seems likely to convince some people that everything they dislike about today’s economy, from slow growth to high grocery bills, is somehow the Fed’s fault.

But it would be a mistake to read the exit polls as a public demand for tighter money. [emphasis added]

Ponnuru simply assumes that a gold standard and its appeal lay in direct opposition to inflation, not only in terms of political thought but also actual operation. The gold standard is neither tight money nor loose money – it is stable money. Inflation is a symptom of instability, monetary imbalance, purposefully created. The gold standard only seeks to remedy the discretion of modern central banks, removing their ability to distort and interject into markets. Take the PhD’s and their pseudo-scientific pursuits out of the complex economy and let the beauty of decentralized information allocate resources, including money.

A gold standard could very well turn into very loose monetary conditions, but that would be driven by actual market demand for money (and would feature rising, not artificially depressed, interest rates). That is inimitable to the elitist economic position on both the right and left because, like Yellen, they distrust (loathe?) free markets and free economic positions. Theirs is a corrupted thinking where the only answers are governmental. Never is government, including its monopoly on money, a source of error and disrepute.

To complete that picture, Ponnuru errs fully in his recognition of both the causes of the Great Depression and the Great Recession.

Excessive tightness by the Federal Reserve made the New Deal possible in the 1930s. Money was much too tight in 2008, too, and it led to the swollen Democratic majority that enacted President Barack Obama’s health-care law. In recent years, deflationary policies have hurt right-of-center parties in Argentina and Sweden as well.

In first continuing with his errant analysis of stable money as “tight” money, he, as with most orthodox economists, denies any causal exposition into the 1920’s as it connects directly with the Great Depression. Because that decade was littered with monetary instability created by the first vestiges of central banking without market restrictions, it would invalidate the very basis he seeks to rest modern inflationism.

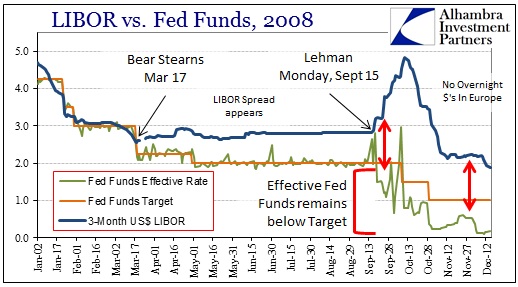

The same goes for the 2008 crisis, though it is clear that Ponnuru, like most orthodox elitists, has very little idea about the internal plumbing problems of modern “money.” He just feels it was “tight.” I openly wonder if he could answer the question of whether durable wholesale market fragmentation was “tight” or “loose” in the fall of 2008; after all federal funds were demonstrably “loose” causing the Fed to “drain” reserves at the very same time eurdollars were “tight” and causing firesales of assets.

In other words, devotion to economic ideology drives this kind of blind faith and worship in orthodoxy. There is no deep understanding on his part or his ilk, only that there can be no alternatives allowed or even countenanced. There can only be room in the economy for inflationism, no matter its sordid history, as monetary stability imparts too much freedom. Better to remain in ignorance over both modern function and history of that function than to give people back their economic freedom in the recognition of the failure of Kallipolis. They are smarter than you and that needs to be codified into politically-backed inflationism, a sentiment of infection across the political spectrum.

Click here to sign up for our free weekly e-newsletter.

“Wealth preservation and accumulation through thoughtful investing.”

For information on Alhambra Investment Partners’ money management services and global portfolio approach to capital preservation, contact us at: jhudak@4kb.d43.myftpupload.com

Stay In Touch