Working with my colleague Joe Calhoun (mostly him), we’ve come up with what we think is a list of questions that quite naturally arise from this week’s discussions of bank reserves, some specific and technical, the monetary system, some theoretical, some practical, and the (much) wider economic consequences which follow from those.

1. When the bank buys a Treasury note/bond/bill at auction, where does the money come from? When the Fed then buys the Treasury from the bank in QE can’t the bank then use that money for something else? Like buying stocks?

The bank has several different ways of funding what are called “warehouse” activities – the very functions we need primary dealers to carry out in order to best promote the smooth flow of money/credit throughout the real economy. Dealers buy debt securities at all kinds of auctions (not just Treasuries floated by the government) and then “warehouse” those securities so that over time they can be sold off to the financial public (less any amount of each securities the dealer wishes to retain for its own purposes).

The repo market, in particular, came about to help service this function, to the point it had become nearly indispensable; a dealer could tap the repo market for securities held in inventory during this warehousing process. That’s one way of funding auctions, and it was much more common during the pre-crisis era particularly when it came to the issuance of mortgage-backed securities (MBS).

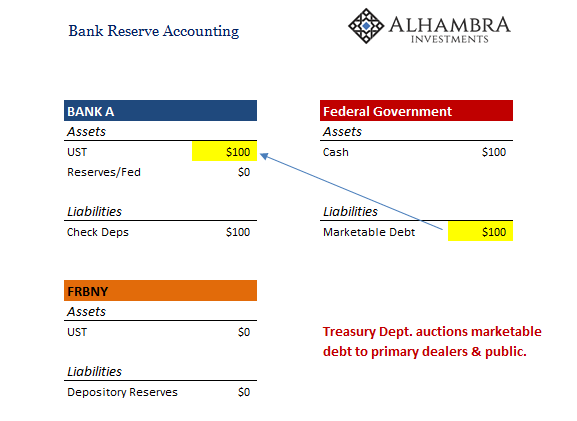

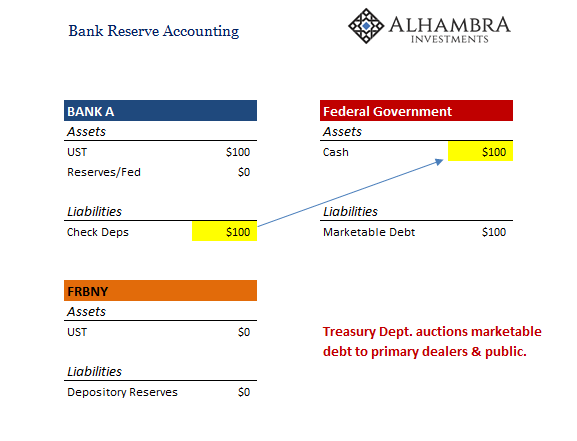

An alternate way is for the dealer to act like an old-time depository and just create a deposit liability (shown above); in this case a checkable deposit.

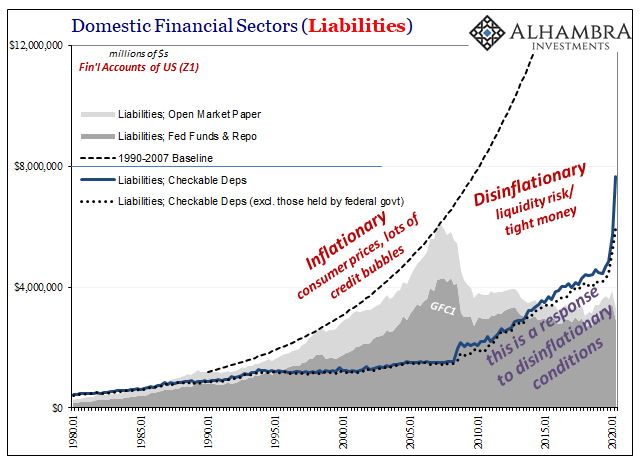

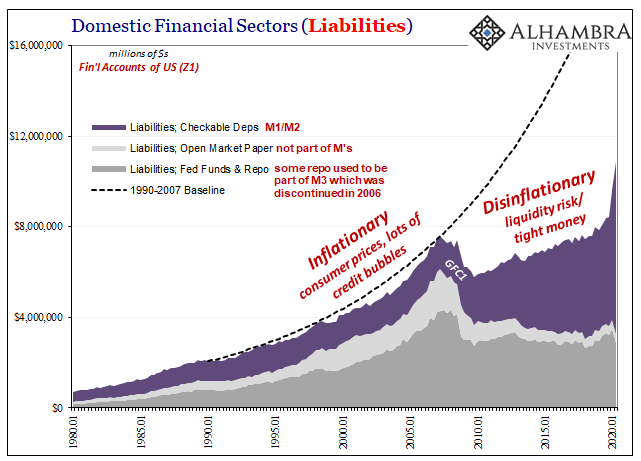

It’s important to note that the banking system as a whole has greatly changed its preference, this demarcation falling exactly during the first global financial crisis (GFC1, nothing more than the first outbreak of a global dollar shortage); what I called yesterday the liability swap.

Less of the wholesale funding, more of the deposit kind (below). This a clear sign of balance sheet de-risking.

All of that comes before QE ever enters the equation. On the asset side, the dealer simply makes a swap from a UST for the equivalent amount in bank reserves. Thus, the asset swap which follows the aforementioned liability swap, the final form of the asset being held a choice made by the dealer between bank reserves offered by the Fed and UST securities held after auction.

There is no link between the stock market and the monetary system.

2. Isn’t there a limit to how many Treasuries the primary dealers can buy? Is the purpose of QE to free the banks to buy more Treasuries?

Primary dealers are obligated to buy up any or all UST’s that might not otherwise get sold during any auction. That’s the theoretical cost of being a dealer, outweighed by the privilege of engaging in dealer activities especially the last decade when demand for what’s been auctioned has been, at most times, totally overwhelming.

And repo demand for these specific securities even more of a high privilege (that’s another story).

The purpose of QE, on the other hand, is actually the opposite. By buying UST’s (or MBS) from dealers, the Federal Reserve is actively encouraging these banks to go out into the riskier portions of the credit markets and replace those risk-less securities sold with activities undertaken there (risky bonds/securities as well as lending).

It is these riskier segments which benefit and encourage recovery and economic growth, not holding UST’s. By removing safe assets from dealer hands, the central bank is counting on what are called “portfolio effects” or “rebalancing”, the presumed profit motive which is supposed to push dealer banks (thereby encouraging other banks to go along with them) out of lower yielding risk-free assets.

In practice, QE does nothing to alter perceptions (and reality) of liquidity risks – despite all the constant hype about “money printing.” Dealers, like any other business, make decisions on a risk-adjusted profit basis. Therefore, while it may be nominally more profitable to sell safe assets to the Fed (or any other central bank undertaking an LSAP) while buying riskier, less liquid assets to replace them, it is not perceived to be on a risk-adjusted basis.

Perceptions of continued high risks, liquidity foremost, have instead convinced dealer banks (thereby encouraging other banks to go along with them) to cling to the most liquid and safe assets no matter the nominal level of profits. Those assets can be either UST’s or bank reserves.

3. If MMT is the next step (or if it is already happening), then won’t that be inflationary eventually? Surely, the government can’t spend unlimited amounts of money without causing inflation, right?

The issue is entirely one of “transmission mechanism.” In other words, how either the central bank or the central government gets money out into the real world. The central bank relies exclusively on the dealer network, specifically, and the banking system as a whole to do its “dirty” work when it comes to money (since the banking system is what actually creates usable monetary forms, not the central bank).

It has been merely assumed that the banking system would simply obey central banker inputs and then act in the manner the central bank policy specified.

In the post-crisis era, on the contrary, the banking system has completely defied monetary policies at each and every turn (as stated above), leaving central bankers perplexed by this “clogged” transmission mechanism.

To get around the clog that is banks, the government could, in theory, transmit and redistribute money directly to people and businesses. This is the basis for most of MMT’s propositions; using a combination of tax policy and credits (or just helicopter payments) to basically recreate the central bank within the Treasury Department; implying, to have the Treasury Department achieve what the central bank clearly cannot.

The difference here is not one of clogged transmission but of type; for all its faults and indulgences, the banking/dealer system performs (imperfectly) an invaluable service. Warehousing is just the front of it. Called intermediation, money/credit flows to where it is most urgently needed and where it can be most effective – in the sense of creating sustainable economic activity, called “wealth.”

The common counterargument against banks intermediating is, obviously, subprime mortgages.

MMT proposes to replace the entire banking system’s intermediation function with one which would be accomplished by a small group of centralized bureaucrats developing complex algorithms and econometric models (using supercomputers!) to decide who gets what from the government at which specified times (just like Positive Economics, still ignoring Mandelbrot).

While doling out excessive money arbitrarily sounds like it can only be inflationary, this might happen (I would argue this would happen) at the expense of other sectors (what used to be called crowding out). What would a left-leaning government pushing money and credit to “green” projects mean for the existing oil industry which, for the past decade, has been one of the very few sources of economic expansion?

Or a right-leaning government perhaps over-eager to “invest” in defense industries and the like at the expense of something like educational services (both of these partisan examples are intentional political stereotypes)?

The end result might (would) as easily be deflationary just as subprime mortgages ultimately were; if you abandon true intermediation, or cannot in any way duplicate it legitimately, you risk funding, like subprime mortgages, a whole lot of stupid and wasteful activity which inevitably comes crashing back down in a deflationary mess.

“Unexpectedly”, despite so much probability math.

MMT proposes to replace the current idea of a small cabal of bureaucrats purporting to control a banking system which does the money in a way it really does not understand with a small cabal of bureaucrats controlling the government which would undertake money in a way no one will understand (even though MMT proponents claim, like their central banker forebears, it’s really easy).

Neither fosters (true) intermediation which is what creates value, leading to wealth, and in the end sustainable economic progress. Adam Smith’s remarkably consistent invisible hand.

4. Okay, I see that if the primary dealer sells the Treasury to the Fed nothing happens but what if the Fed bought bonds or some other asset in the open market? Wouldn’t that put money directly into the economy? What if the Fed bought crude oil and stored it in the SPR?

This is currently illegal. The Federal Reserve has certainly proved beyond a doubt that it will, at times, openly circumvent many of its statutory restraints, making significant use of the broad emergency powers assigned to it under 13-3, but this one would require further explicit Congressional approval. Openly buying speculative instruments of any kind would represent an unambiguous material violation of the Federal Reserve Act (and, in fact, is one reason why repurchase agreements are called repurchase agreements in first place).

Even if we assume that in the future such approval is gained and the Act amended suitably, the Fed would still run into the same problems as MMT. See #3.

5. Okay, I get that the banks aren’t lending but corporations have just gone on an orgy of bond issuance – credit isn’t scarce. Why does it matter that banks aren’t taking risks if the bulk of lending is in the bond market?

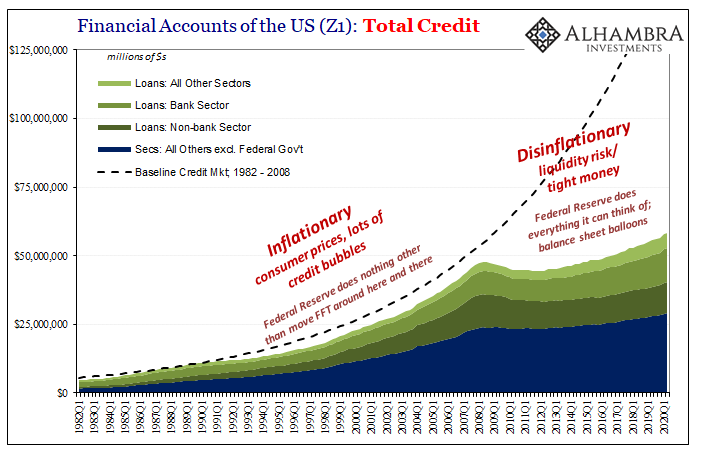

This is a widely held belief, that via low interest rates as a consequence of central bank monetary policies (ZIRP + QE’s) a credit bubble has been created; an orgy, even.

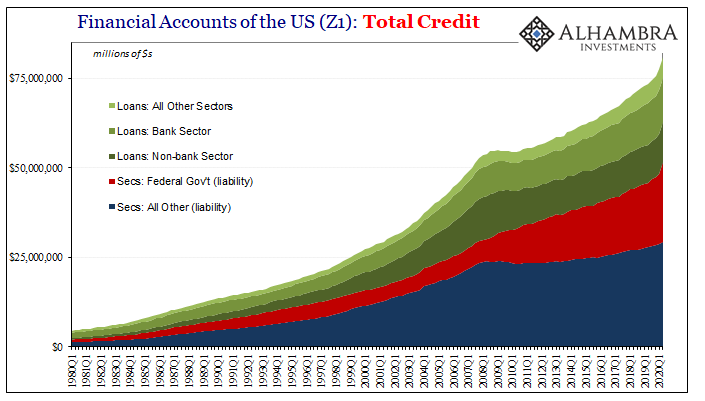

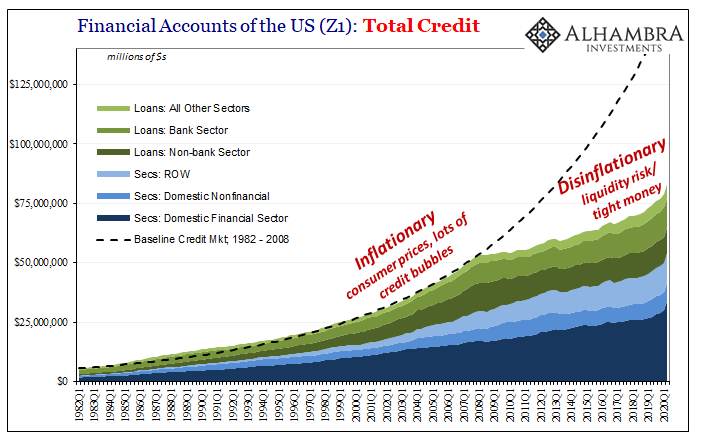

It is a demonstrably false perception (below). There is and has been no credit bubble. While the bond markets have offset a small level of the banking system’s redeployment (in nonlinear terms), it is by no means a bubble nor even approaches those proportions.

In fact, the majority of this credit “bubble” has been undertaken (here and abroad) by sovereign governments. As noted above, the desire for safe and liquid assets continues to be overwhelming precisely because monetary policies have failed in every way.

And that includes the low interest rates themselves; falling yields on even junk bonds does not suggest an excess of credit. To the contrary, lower yields even on riskier instruments is perfectly consistent with, and further evidence of, a chronic and systemic tight money condition.

The risky equivalent to the interest rate fallacy.

As always, even during the worst of monetary times, such as the last decade, conditions favor the most liquid propositions which often means the biggest and most well-connected of financial and non-financial firms have no trouble finding credit and cash.

However, you end up hearing only about the private equity fund or Fortune 500 tech company which is flush with cash, even though at the very same time there is little to no cash cushion nor available credit at the lower ends of the economic spectrum – particularly small and medium-sized businesses none of which show up in a bond index or in the pages of the Wall Street Journal.

You see the liquid, and only the “puzzling” effects (like low interest rates) of the vastly more illiquid.

The issue, again transmission mechanism, is the free flow of sufficient credit that through functioning intermediation can reach all relevant and necessary economic segments and tiers. Prioritizing parts is a symptom of dysfunction.

6. Private equity and venture capital funds are flush with cash. Again, it doesn’t seem like there is a lack of risk capital.

See above.

7. What if China dumps all their Treasuries?

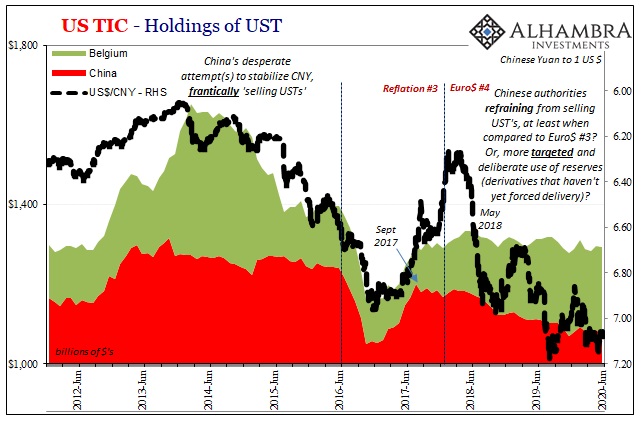

The Chinese “dumped” nearly $1 trillion of their stockpile of foreign assets, hundreds of billions specifically US Treasuries, during the third global dollar shortage event 2014-16 (Euro$ #3). The end result was CNY (not the dollar) crashing and UST prices rising (not crashing) precipitously.

Both were related consequences of the global dollar shortage.

In economic terms, the US economy suffered a near recession at the end of 2015 while the Chinese economy downshifted beyond every previous standard for minimum growth. It has remained in this shape. In other words, even for all the selling and chest-thumping, China not the US was left in worse shape (on a relative basis that begins with the US ending up, and remaining itself, in bad shape).

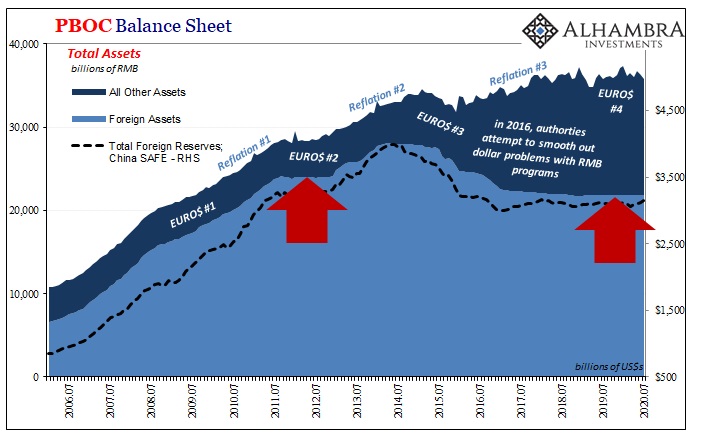

While Chinese Communist officials make the occasional claim that they are going to use UST’s as some kind of weapon (because it makes for spooky TV playing throughout America), in practice China’s economic and monetary authorities have done just the opposite since Euro$ #4 erupted at the end of 2017.

As we’ve written about frequently over the last year, year and a half, the Chinese are making an obvious concerted effort to avoid selling UST’s as much as possible. The truth of the matter is, as demonstrated during Euro$ #3, utilizing foreign reserves (and China is not the only negative example) can, in fact, make the dollar problem worse at the same time it leads to serious, harmful internal monetary constraint; in China’s case, RMB growth suffers in physical currency and more so an outright reduction in bank reserves (call it involuntary QT).

The Chinese monetary system, like most around the world, had been “dollarized” decades ago. Each made a conscious choice and rode the eurodollar system’s excesses to massive economic heights while never stopping to consider how a potential chronic reverse in the monetary system could cause these intractable economic and monetary restraints they’ve been trying to deal with for nearly a decade.

That it has been a decade already demonstrates perfectly just how intractable the dollar shortage really is.

They need our Treasuries. What they need more are bank-created eurodollars they can’t get.

8. If all this QE and Fed stuff is just hand waving, how can the economy be recovering? Didn’t they save the world? Again?

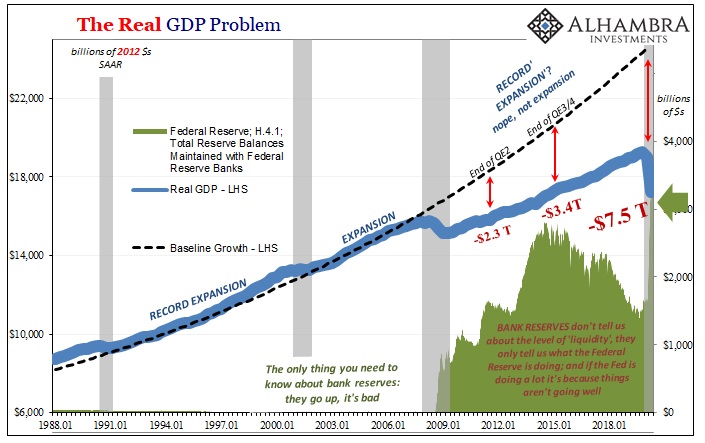

Like 2008 and the Great “Recession”, the economy suffered a major shock, was painfully expunged of a tremendous amount of activity, and then quite naturally reached a devastatingly lower state of “equilibrium.”

Monetary policies didn’t create it; they were designed to first prevent such a crisis from ever happening (no luck there) and then cushioning the blow once the shock took hold anyway (less luck there). Post-GFC, monetary policies were then supposed to help foster the positive monetary and financial conditions conducive to full and complete recovery (strike 3).

This is why in econometric modeling, models that begin by assuming monetary policy always works, the only “evidence” for the effectiveness of QE/ZIRP is the counterfactual “jobs saved.” In other words, because they assume central banks are effective, but they weren’t very effective, then without them it surely would’ve been so much worse.

In 2020, we are witnessing the same generalized results with one twist; the biggest blow to the economy was suffered right from the start rather than at its end like the Great “Recession.” But therein lies the problem; we’ve already suffered the recession which means we actually remain in its grip.

What that could mean moving forward is more about the slope of the rebound, hoping that slope is steep and more than that sustainably steep. That would equal recovery.

And monetary policies, just like last time, are being described as helpful toward that end.

Markets, especially since July, are starting to price a growing probability that the rebound slope has: 1. Been driven more exclusively by reopening momentum alone, the simple act of governments removing COVID-related restrictions and allowing businesses to reopen or ramp back up, workers back to work; 2. Monetary policies, just like last time, haven’t added anything (see: dollar; UST yields; curve flatness, etc.); 3. That if the slope of this rebound does begin to bend downward “too soon”, that could potentially unleash harsher, more harmful second and third order effects.

The problem isn’t an economy that’s putting up positive numbers, rather it’s asking the question are they actually positive enough? This is the problem which plagued the global economy following the depths of the Great “Recession”, confusing many by the appearance and persistence of so many negative consequences despite so many positive numbers.

The Federal Reserve doing more of the same things it has done for the last twelve years is uninspiring in a way it wasn’t a dozen years ago when central bankers had been afforded more benefit of the doubt.

9. And finally, great, I agree with you. What should the Fed do instead that would work? Or is there absolutely nothing the Fed can do? And if that is true, how do we get out of this mess? Are we just doomed?

Transmission mechanism + intermediation = real recovery and sustainable growth.

The current incarnation of the central bank, one predicated upon expectations management, is (and has proved it is) incapable of solving this simple equation. The reason is the monetary system and its bank-centered nature. It was irretrievably broken on August 9, 2007. All central bank policies around the world have been predicated on the assumption there are only one-off issues, including GFC1.

As a result, in ignorance, current monetary policy focus is that which has guided Japan (into the toilet): credibly promise to be irresponsible. To make the banking system and the economy at large believe each central bank is committed to excessive, inflationary money printing and thereby act in such a way that the, pace Keynes, the economic pump gets primed.

Instead of constantly rewriting the same fairy tale, what might actually work (and I argue that it would) is the opposite: credibly promise a responsible monetary system. One that is almost totally transparent, rather than hidden away deep in the global offshore shadows. A monetary regime with simple rules that everyone understands, rather than being incapably complex and the exclusive domain of only the largest global banks’ highly specialized trading desks.

A credible promise for a responsible monetary system would bring together traditional sound money characteristics with modern innovations and advances (this is just its slogan, not the extent of its details).

Such a thing would encourage a high level of intermediation (via productive, rather than financial, opportunity) along with, modern innovations and advances, the ability to redistribute monetary and credit sources in the most efficient and effective manner possible (and, unlike MMT proponents, I don’t think this is easy at all – but it is one thing the eurodollar system solved quite elegantly).

Above all, we have to remember that money isn’t wealth. It is a tool which is used to promote economic efficiency; the specialization of labor as well as the exchange of goods and services in the broadest sense humanly achievable.

You can certainly build a house without using a hammer or an electric saw. It would take forever and the final product is unlikely to be desirable. With the right tools introduced at the right times (intermediation + transmission), however, it gets done efficiently and the final product highly advantageous. Repeat the process, and you’ve really got something.

In short, how do we fashion the monetary system into the best possible economic tool it can be? Technology and a mix of traditional resolve. A 21st century answer to an ages-old problem. That would, I believe, give us much better shot than what we have now: a 1960’s understanding of the 1930’s.

Instead, I wrote almost three years ago:

It may be that our future depends upon how successful we can become in this way, accepting blockchain no matter what ancient Economist decries it, or whichever political figure who clearly doesn’t get it or our real monetary problem seeks its official exile. As if we needed any more of them, it’s another race or countdown. The primary issue after losing one decade is always really going to be time.

We are going to go from A to B one way or another; willingly by design, in a messy, uncontrolled reset, or some ways in between . There are today even after ten years still some positive outcomes possible. I worry that timing (Bernanke’s real legacy) may be conspiring to take one of those few away before it ever really gets started.

Three more years later, any closer? Yes, concrete progress but still only baby steps. There’s just never enough urgency, because so much is confusing, and confused, not enough have yet been able to connect all our economic, political, and social problems with their primary source.

Others will continue offer their own solutions given this vacuum.

Stay In Touch