Balance sheet capacity as an intangible (and deeply misunderstood) monetary property is the biggest motivating factor behind changes in or to the offshore, shadow ledger-money reserve system. The eurodollar. Since it is a distributed ledger shared amongst, and kept by, the big-bank global banking cabal, its members’ ability to expand their own individual balance sheets contributes to the overall increase in availability of the eurodollar as (fictive) reserve currency.

Or, contrarily, contraction in those balance sheets squeezes the vitality out of the global economy and occasionally financial markets.

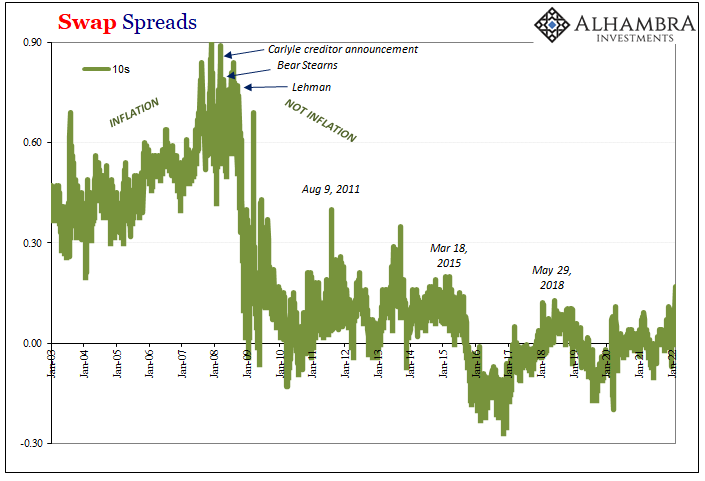

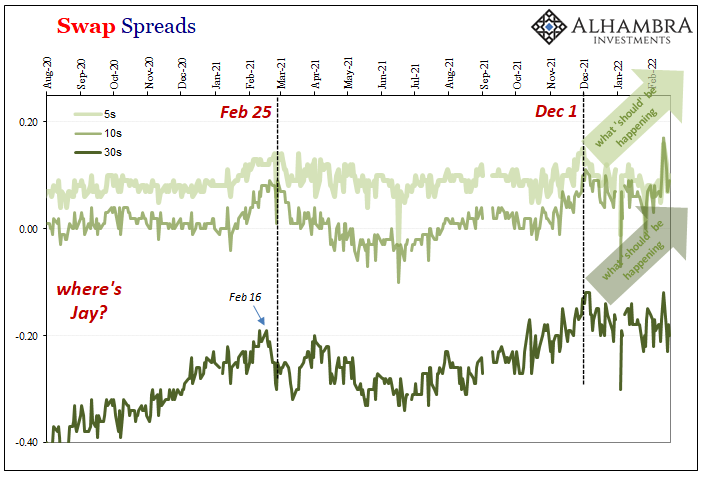

Interest rate swaps and their relation to nominal US Treasury yields – swap spreads – give us a very important sense of specifically starting with balance sheet capacity; particularly when the general shape and behavior of those spreads may corroborate the same in other parts of the true monetary marketplace.

Quite simply, it takes some financial institution’s balance sheet capacity to take on an interest rate swap (the farther the maturity, the more capacity it requires). If balance sheet capacity (the real money in the system, therefore liquidity) is systemically impaired, as in a crisis, or a crisis that doesn’t really end, then to get dealers to give up their precious balance sheet capacity and engage on the other side of a swap someone would have to pay a hefty premium to make it worth it (risk-adjusted) for the dealer to do so.

Taking up so much more balance sheet capacity relative to other swap tenors is why the 30-year swap spread lags; as in, it was the first to go under zero and remains the deepest into the negative and most profoundly refuses to come back up into the range of even small positive spreads like the 5-year or 10-year.

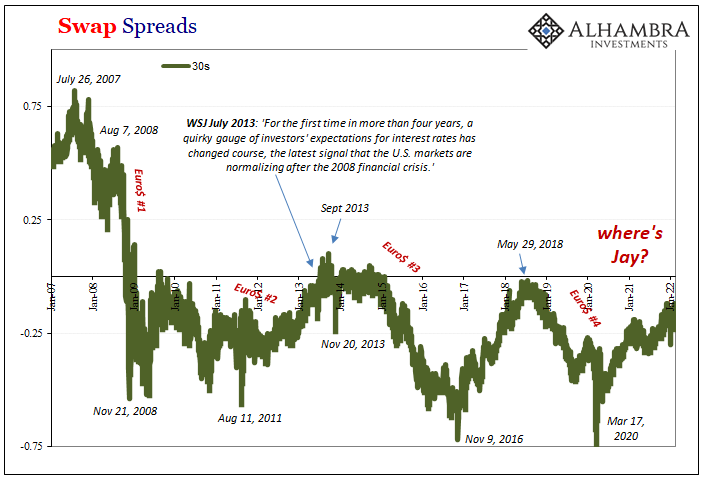

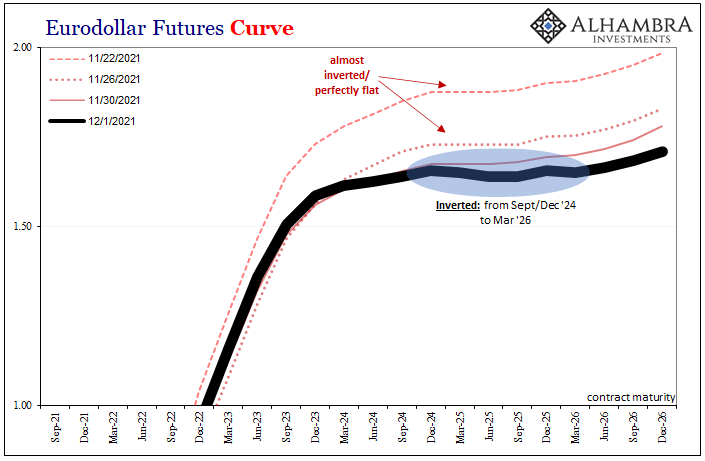

For only a brief moment, anyway, back in 2013 the 30-year swap spread had turned positive, though only by a little tiny bit. Still, getting to the plus side appeared to be another one of those constructive signs of possible recovery along with steeper yield and eurodollar futures curves – corroborating signals of higher growth and inflation expectations along with expectations for higher short-term interest rates.

The latter is also a crucial motivating factor for interest rate swap prices and spreads. Since the contracts are, by nature, fixed for floating, therefore one side of the trade is pegged to short-term interest rates, yeah, perceptions about short-term interest rates play a key role in pricing swaps (relative to nominal Treasuries), too.

When the 30s turned positive in July 2013 alongside other market changes in the same direction, it had indicated relatively looser balance sheet restraints as well as what that might mean insofar as future potential rate hikes sticking.

Taper celebration, not tantrum.

It just didn’t last because those relatively more positive vibes didn’t stick around for very long (something about China). Both swap spreads (at the 30s) and eurodollar futures (flattening curve) began to rethink the celebration as early as September 2013 – and Euro$ #3 followed closely after.

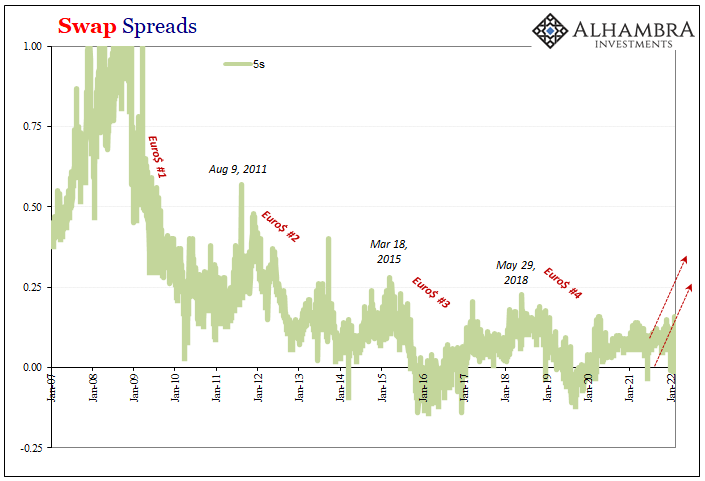

The shorter the duration or maturity the interest rate swap, however, the more the expected path of short-term rates might influence the swap price therefore spread relative to pure balance sheet constraints. When you get to something like the 5-year, it’s both balance sheet capacity as well as the expectations for short-term rates like in the 5-year UST.

So, for instance, if the whole global eurodollar system and bond market really starts to believe in higher short-term interest rates that stick around for more than just a fleeting moment (see: 2018), the 5-year swap spread at the very least should be more than meandering its way in that same direction.

It really, really shouldn’t be too much given what’s been said about this year for the 5s swap spread to get up into the 20s if not 30s on just the expectations for short-term rates as a start.

Yet:

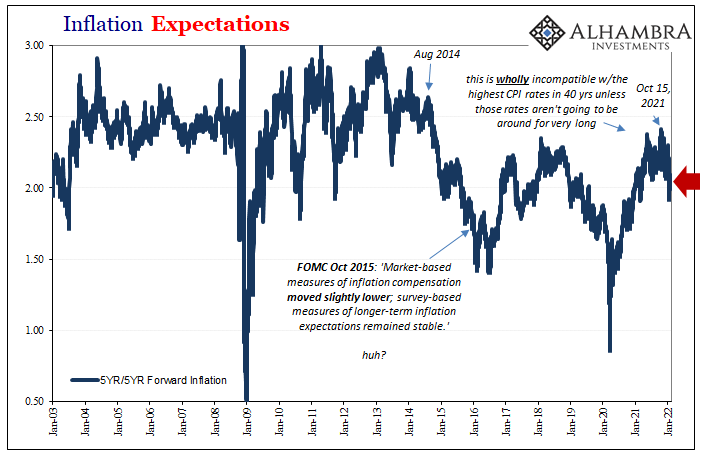

Where’s this massive inflationary wave? Or, if you prefer the Fed Cult view, where are even the rate hikes we’re supposed to believe are necessary to stop it? Going back specifically to the last two months of 2021, even as an aggressively hawkish Federal Reserve makes its intentions along these lines perfectly clear, we are left asking the swaps question of why the 5-year swap spread – in particular – isn’t doing what it “should” be doing.

Swap spreads – and not just the 5s – really should be significantly decompressing, instead they have compressed during what has been claimed the most fertile ground in decades for them to go otherwise. Spreads haven’t been crashing by any means, but they are relatively lower since December 1 which by itself represents a substantial counterpoint.

That particular date should ring a whole bunch of bells, too. What else happened on December 1? It was, you may recall, the same day when the eurodollar futures curve first inverted (in this “cycle”). Remember what I said about corroboration.

CPIs have accelerated, Jay Powell’s language and projections have followed those more aggressively, yet another deep financial market indication closely tied to money (balance sheet capacities) like the expected durable path of short-term interest rates is trading a whole different set of possibilities.

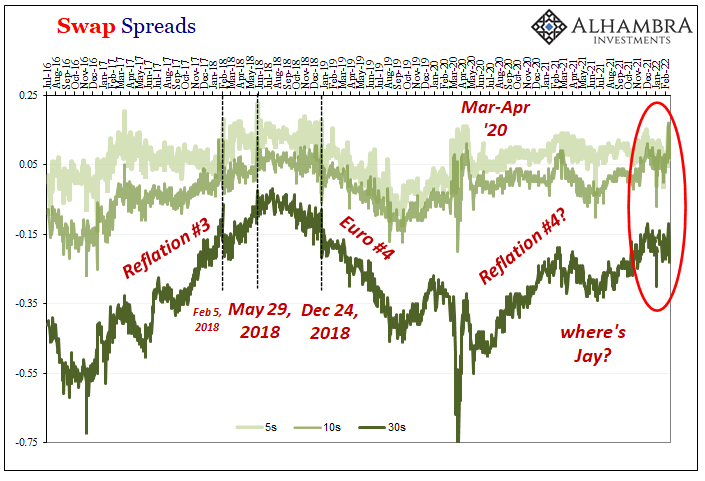

Of course, it’s not just the 5s, either; the 10s like the 30s have behaved similarly, each changing course to compression within days of eurodollar futures and the 5-year swap spread.

In fact, the 30-year swap spread topped out (for now) on December 3 – the same day when that original eurodollar futures inversion surprisingly expanded by more than a few bps.

Omicron fears, they all said. Maybe it was – back then. Not now, not in the middle of February 2022.

“Something” else is very clearly going on, the market – the entire global money system and these mammoth, deep and sophisticated financial pieces to it – it is uniformly altogether rejecting taper and even rate hikes, the latter being priced as at most a temporary measure imposed by non-economic considerations of policymakers blinded from politics and bad inflation theory.

At least in Summer 2013 Ben Bernanke managed to court an albeit brief taper celebration. And in 2018, Janet Yellen had bequeathed Jay Powell less than that but still optimistic possibilities (if only until May 29 when spread began compressing, and then eurodollar futures inverted two weeks later).

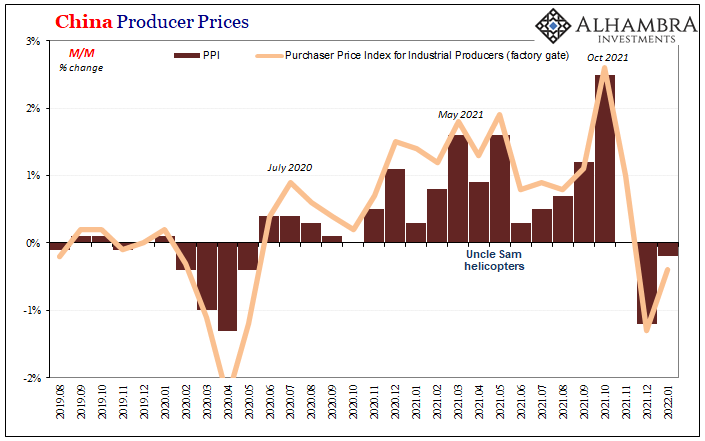

Last year was said to have been the Year Of Inflation when in truth it was a year for rising deflationary potential – the flat yield curve like swap spreads, these go back all the way to last February 24 (yes, Fedwire). Nominal yields are up on nothing more than the expectation of rate hikes in the short run, while everything else from curve shapes to these various spreads is wondering what planet policymakers are making policy for.

It isn’t the one we inhabit; we all live in the eurodollar’s world.

And I’ll reiterate again – all this despite CPIs and mainstream confidence in inflation at levels we haven’t seen and heard in decades. The contradictory evidence runs very, very deep.

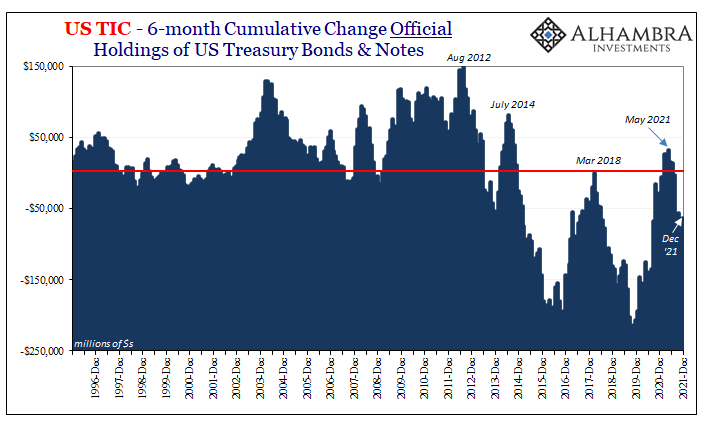

It is not inflation, there is no flood of money, or even enough money, for that matter (why $47 billion in Treasuries demanded in Belgium during December?), and the risks keep tilting more and more toward the downside, the deflationary (or disinflationary) potential that never really went away at point.

In fact, that’s the long run takeaway from swap spreads like the yield or eurodollar futures curves. Nothing had changed in 2020 or 2021, nothing good, anyway. Even though consumer prices stole the show for a time, this was all a price illusion based on a supply shock which obscured the underlying situation market and money indicators keep coming back to no matter what the Fed or the financial media says about growth and inflation.

That’s why interest rates only ever go lower given enough time, eurodollar futures curves only grow flatter with time, and swap spreads never seem to come back up as far each time.

If there was just one curve or one market that was out of line with the mainstream inflation narrative, fine, outlier. When every market indication is, at what point should you stop making excuses or just ignoring all of it because of how uncomfortable it might be?

If you’re someone at the Fed, their answer remains a whole bunch more of Bill Dudley’s legacy.

Taper Rejection meets Policy-Error Error.

Stay In Touch