The TIC data is great, it’s fantastic and wonderful if by comparison to the utterly slim pickings available elsewhere – which is practically nil. Compared to what I’d really like to know, the series leaves a ton out there. This is understandable if still unforgivable; on the one hand, the Treasury International Capital report itself predates the eurodollar system by a few decades.

Yet, for the sixty-some years of offshore dollars and the eighty-some years of TIC, you’d think that someone in all that time somewhere in the government would’ve put some of these pieces together and expanded survey coverage to match real world money and finance. Nah, Paul Volcker or something.

Among TIC’s greatest data deficiencies is repurchases (or resales, from the opposite perspective). Showing both its age and outdated worldview, the TIC instructions specifically instruct respondents to exclude any collateral exchanges (repurchase or resale) which don’t involve cash as collateral.

Yes, pretty much all of securities lending where any security lent or otherwise transacted backed by some other form of security that isn’t cash, the US government doesn’t want to know about it. Truly a shame how, to this day all these years after 2008, which was about as pure a repo collateral run as 1929-33 had been bank runs, the focus is entirely as if it was still 1929 or so.

It’s not an accident that the original, primitive TIC effort began in earnest in 1934.

Not all hope is lost, however, for as much as this leaves crucial information just floating around undiscovered, some securities lending does show up when a security is lent out and the lender gets back a bit of cash as collateral for it. We just have no idea how much this might be, as it all gets lumped together with other reported (8400-7, the “of which” section) resale and repurchase claims and liabilities.

With this out of the way, and apologizing on behalf of our ignorant government who didn’t do more but really should one of these days, here’s what we have on our minds for the September 2021 TIC data:

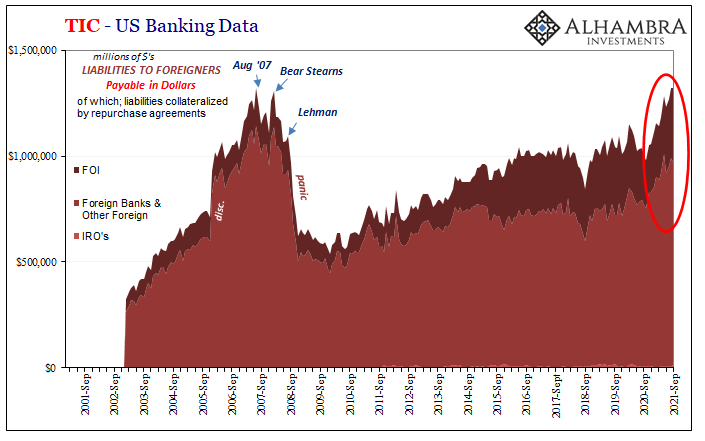

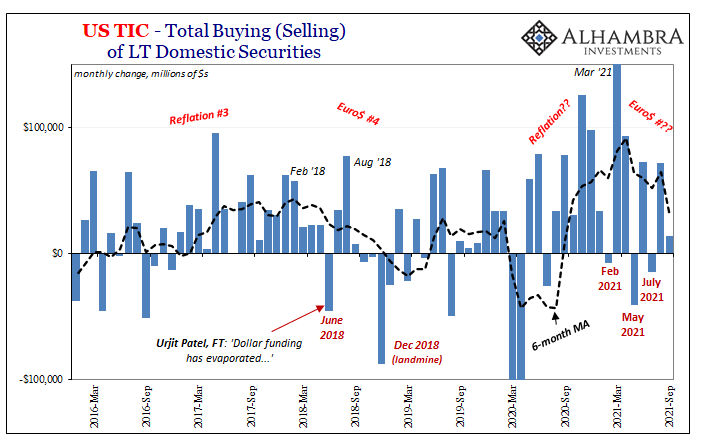

That’s quite a remarkable increase in US bank liabilities collateralized by repurchase agreements with foreign entities; all payable in dollars, of course. But it’s not just the increase, there’s the timing (I’ll get to in a moment) as well as specifically one class of those entities which increased the most: FOI’s.

What’s an FOI?

It is a Foreign Official Institution of some kind, meaning an overseas central bank or perhaps a finance ministry, maybe even a sovereign wealth fund (I can’t get any answers how transactions with the latter are classified, as FOI’s or “Other Foreign”). Either way, it’s a government body, which just begs the question what they are and have been doing engaging collateralized repo operations in such immense and immensely increasing size – and what may be happening after they do these things.

Why are so many foreign officials suddenly popping up on the visible side of repo or securities lending? Collateral bottlenecks created by transformations and collateral chains spoiled by stupidity are the story of the last three or so decades.

Collateral bottlenecks created by transformations and collateral chains spoiled by stupidity are the story of the last three or so decades.

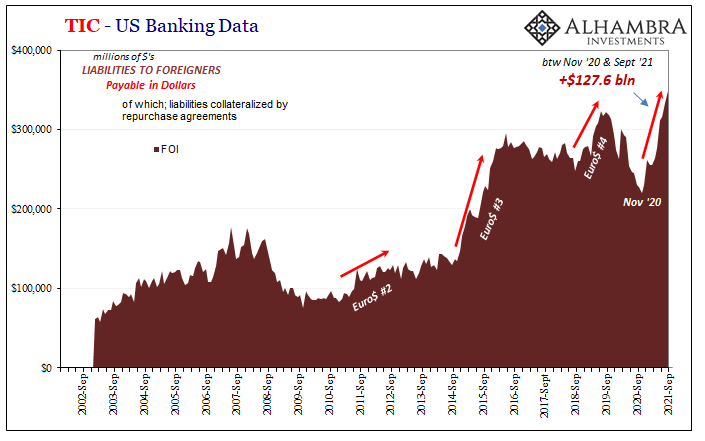

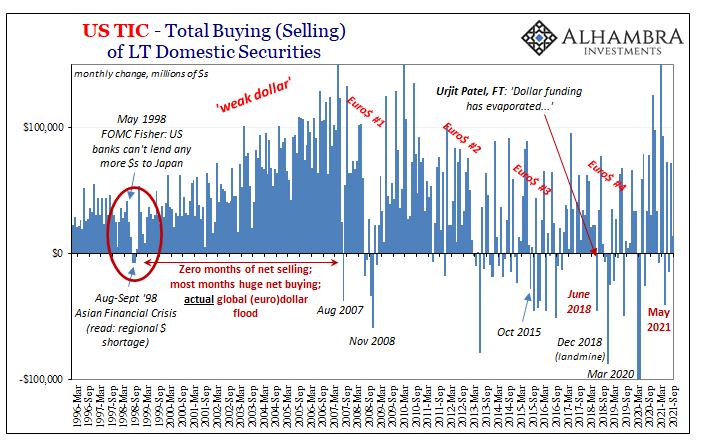

There are two things what we do know for sure, as made obvious by the arrows I’ve drawn on the chart above. First, how these FOI respond to the more acute global dollar shortages in post-crisis era (Euro$ #s 2-4) is quite evidently different from how they managed the first one (Euro$ #1, or GFC1).

Back in 2008 into the devastation of early 2009, they just sat back hoping the Fed would figure it all out (dollars, after all).

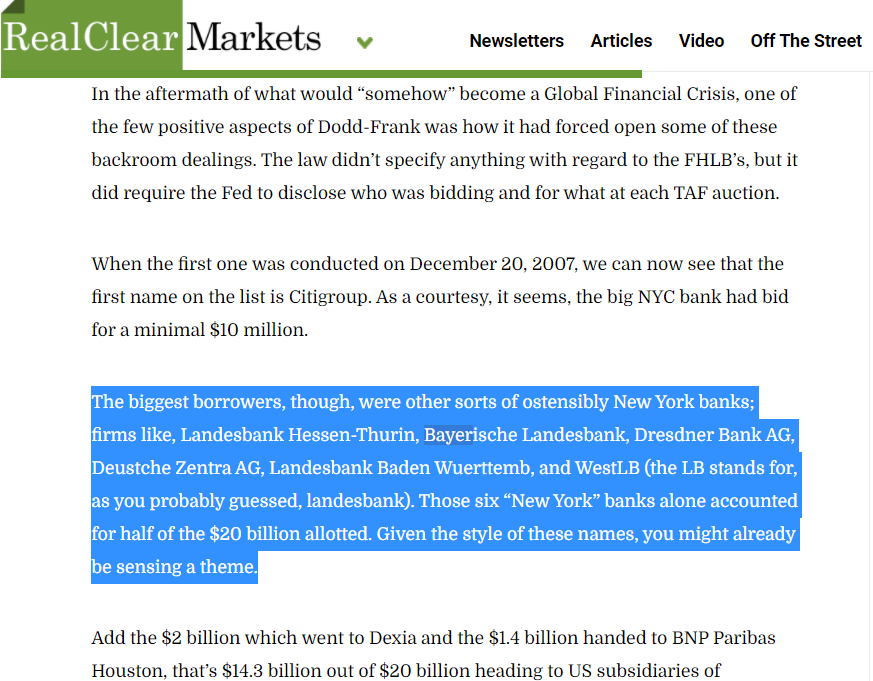

The Fed didn’t, and the FOI’s appear to have figured out, like the money-creating banks themselves did during the crisis, the Fed never would. The US “central bank’s” TAF and overseas dollar swaps are reported in the media as incredibly effective, yet here’s conclusive evidence no one actually counts on them.

Instead, subsequent dollar shortages, such as 2011 but especially 2014-15, these other taps were opened up. Instead of Bayerische Landesbank (I’m using this example hypothetically) signing up for another TAF or counting on some overseas swap auction originated by the Fed to another central bank, what appears to have happened is that “US” banks like Bayerische Landesbank may have transacted securities directly with FOI’s – specifically during these well-documented dollar shortages.

Which then brings us to December 2020 to current (September 2021). The amount of reported activity reported to TIC in this one category defies every notion of inflationary good times and “too much money” overflowing around the world; whatever the media reports of the aftermath of lying liar Jay Powell’s 2020 “flood” of “digital dollars.”

There was and still is a flood of bank reserves, a distinction with every difference as we’ve been forced to witness and chronicle ever since the disastrous nonsense of “abundant reserves” came into being that first time around.

But can we connect what’s implied here, dollar shortage of some substance, with other data tied together in the same fashion at the same timing?

Yeah. Too easy, as a matter of pure facts.

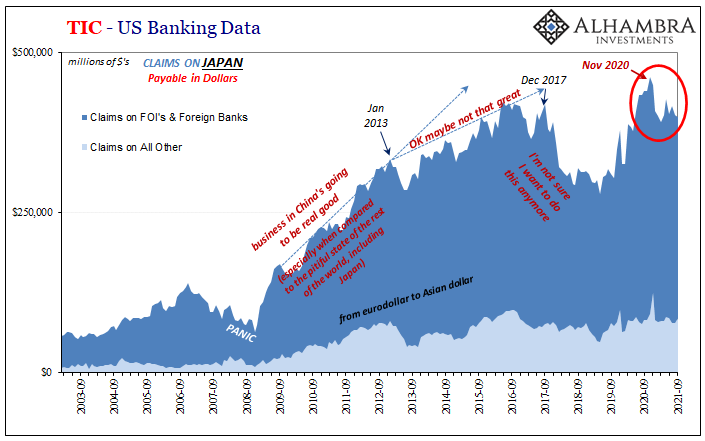

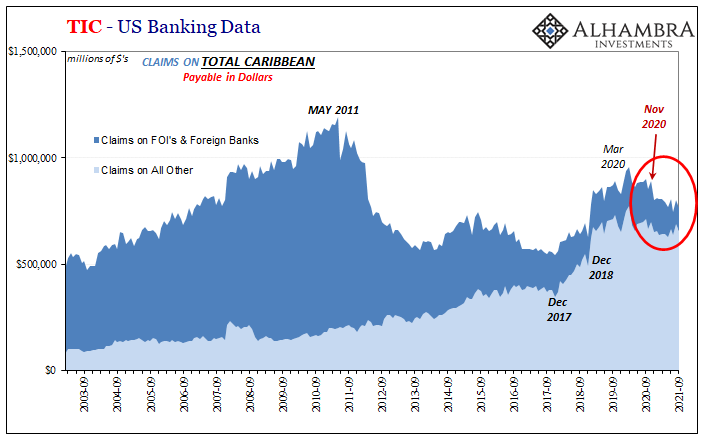

We’ve been talking about TIC in deflationary tight money potential pretty much all year because so much of the rest of the TIC data has indicated the same thing. Let’s start with US bank claims on specific geographic distributions, the two big eurodollar redistribution centers in Tokyo (Japan) and down in Emil Kalinowski’s neck of the woods on Grand Cayman (Caribbean).

In other words, according to this “other” side of TIC, beginning December 2020 an outright reduction (and remember, non-linear terms, any lack of increase is a contraction) in dollar claims which is a pretty good proxy for eurodollar condition overall; particularly when we see both Japan and the Caribbean take a step back at the same time.

Something negative struck the eurodollar’s world way back at the end of last year.

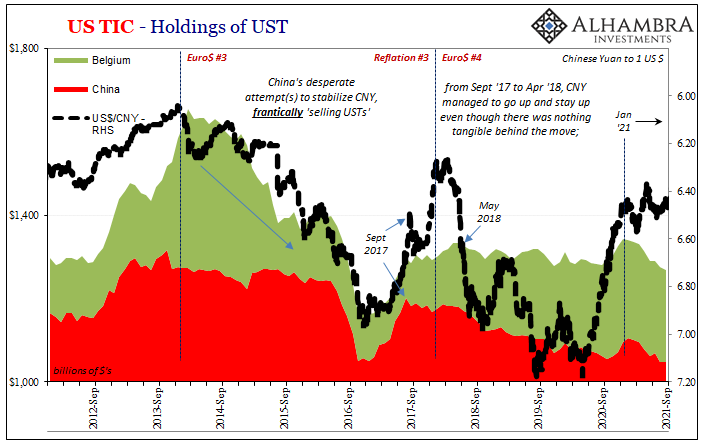

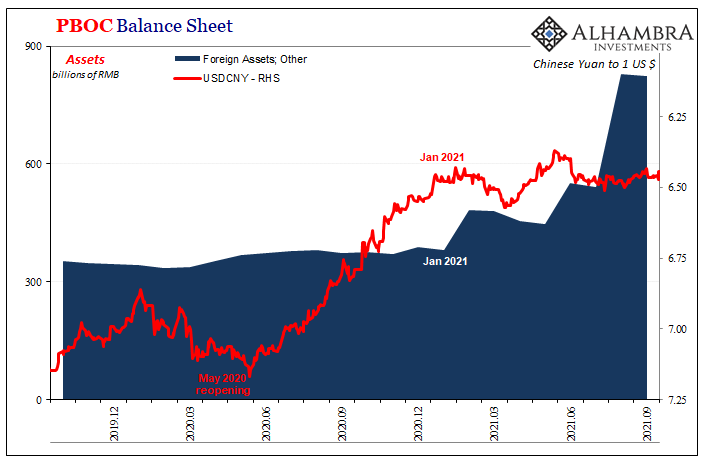

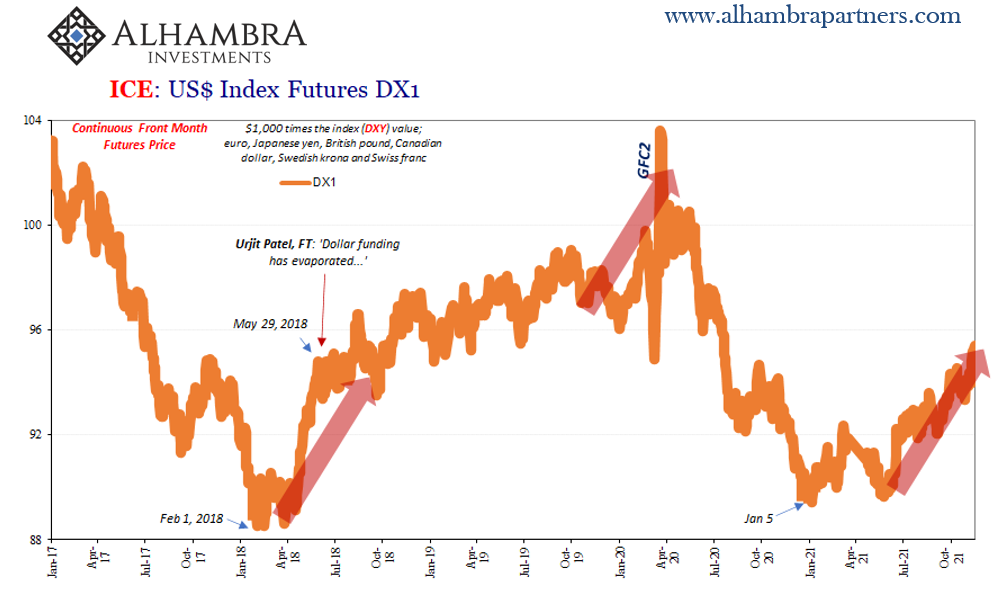

Immediately following this initial December initial setback, China’s shows up all over January. CNY, the PBOC, as well as even more parts of TIC. Even the US$ exchange value, which, as we know even if not reported in the media, a rising dollar is always consistent with tight money (just like low bond yields).

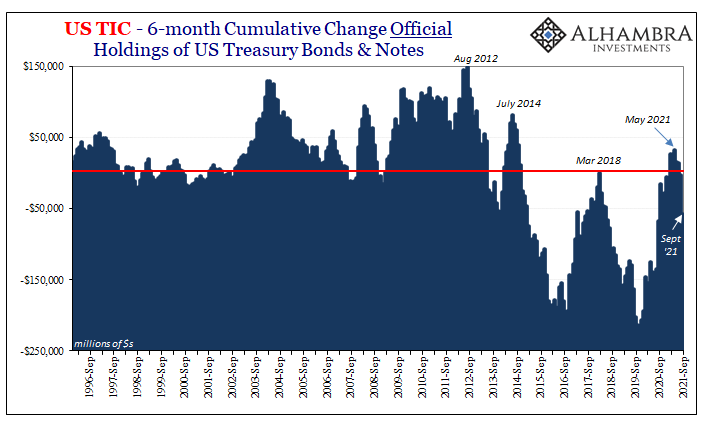

In still other TIC pieces, we see foreigners buying fewer UST’s and outright selling (net) in a few recent months (net buying was down big in September). Perhaps even more importantly, tying this all back to FOI’s, foreign officials have been “selling” their UST’s again in significantly larger quantities; a surefire signal for eurodollar tightness that’s been building bigger (not back better) since around May (there’s that month again).

The second TIC chart I showed up toward the beginning is why I put “selling” in quotation marks. Because of the complexities of this real-world eurodollar system, and how 1930’s era TIC (even if updated many times over the years, the worldview behind the data collection is still similarly primitive) isn’t truly suited to describe it, errors are common in the process and processing.

How much of “selling” might just be the other side of the securities operations showing up in the “red” data, or which doesn’t show up at all because of truly securities lending security-for-security (collateral transformation) specifically excluded from TIC?

These are questions badly in need of answers someday.

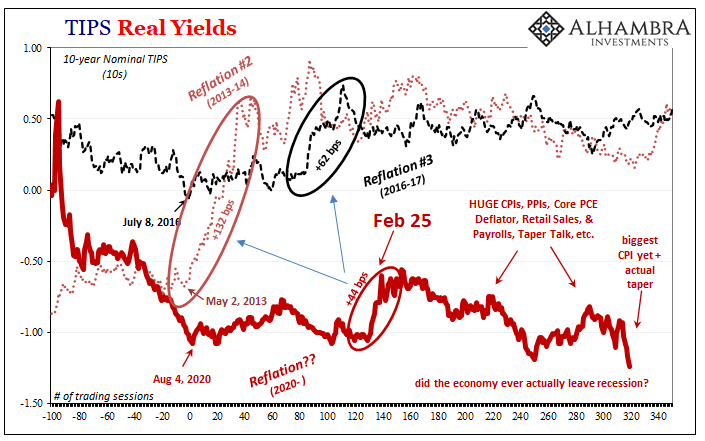

Regardless of whether we ever get them from the Treasury, what we do know with increasing confidence is radiating brightly from these unusually unambiguous correlations up and down the TIC data. Throw in global bond yields and the “unexpectedly” rising dollar, as well as each’s timing, and what you find for 2021 is decidedly deflationary potential if not already significantly tight money conditions working on just that.

Forget the CPI’s, those are obviously not about actual inflation (supply bottlenecks). If anything, what they represent (gasoline) is just another negative to make all this potentially worse.

While impossible to pin down the specifics and the exact details, there’s enough here to describe enough of the broad strokes which adds up to a stunning amount of very straightforward evidence. Consistent. Coherent. Corroborated.

Inflation never had a chance. This whole year has been going the wrong way, though how would anyone have known better? Even TIC itself adds to the confusion, not the least of which for being so outdated – though only indecipherable if you’re stuck like it is in that anachronistic worldview.

“Growth scare” indeed.

The word "robust" has absolutely no business being here.

— Jeffrey P. Snider (@JeffSnider_AIP) November 17, 2021

This is *purposefully* misleading, exactly what I'm talking about; selling an agenda which, in this case, is so brazenly obvious.

They think you won't know the difference. And it's not just China.https://t.co/6Np2eauyrK pic.twitter.com/niiM5gTjMU

Stay In Touch