Jay Powell has had his mind changed for him. Why? Not even a year ago he was downplaying things like federal funds. The rise in that one anachronistic rate was inconsistent with a healthy financial system poised for the good times that come with serious economic acceleration. Quite the opposite, actually.

To dismiss the obvious contrary signal, in very place our central bankers figure only their policy signals apply, the Fed uncorked a whopper. Last April, just as everything was starting to heat up:

Understand what they are saying here. The FOMC is trying to claim that LIBOR is up because T-bill rates are; the latter are monetary equivalents. Bill rates are higher because of, purportedly, tax reform and the Trump budget. In other words, a heavier supply of bills at auction would lead to rising bill yields and therefore as money equivalents other money market rates would move up, too, including LIBOR.

That’s crap.

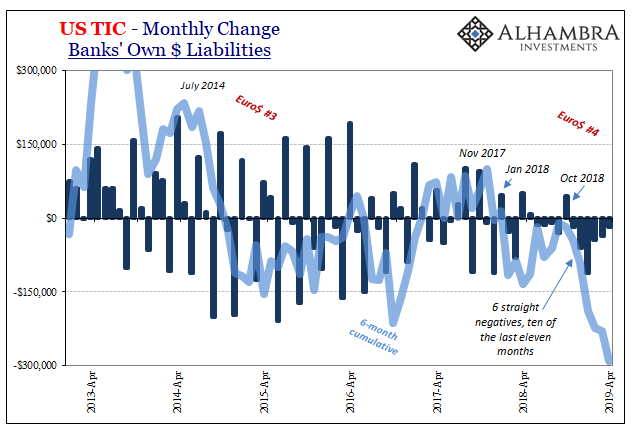

Dealing in offshore money, as we do, there are only a few places to find and source consistent, reliable data. As noted yesterday, as well as each and every month, the Treasury Department’s Treasury International Capital (TIC) series is one such place. Quite by accident, it gives us a starting point from which to begin analyzing global monetary conditions – this eurodollar system.

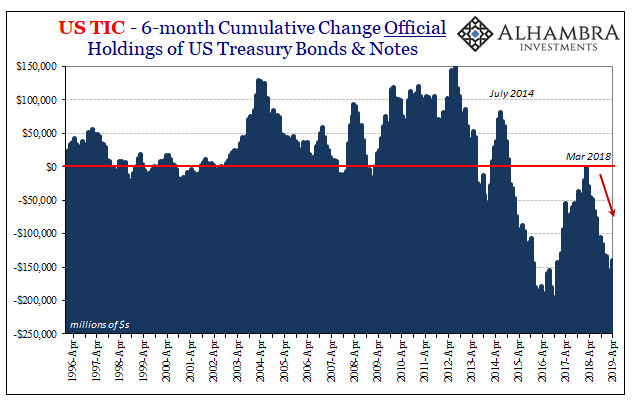

What TIC tells us recently isn’t good, to put it charitably. Bank providers (and money dealer redistributors) have been fleeing at the same time foreign holders of US dollar assets have been selling them (mostly in the official sector, but no longer exclusively). In fact, the two are related to the same problem: a worldwide dollar shortage leaves fewer foreign institutions able to buy US dollar assets while causing mostly foreign central banks to sell their “reserves” in order to make up for the funding deficit.

Or try to. It hasn’t yet worked very well.

This should be very negative for US Treasury securities in particular. Foreigners especially foreign governments hold a lot of US federal government debt. They are, collectively, among the largest class of purchasers. If they are selling, as many of the bond kings like to repeatedly point to, then who can be left buying?

Interest rates would be rising – if this was all there was to the matter. Someone else is bidding up UST’s as well as other forms of equivalent sovereign debt (bunds, JGB’s). Most people think about bonds from their own perspective; from the standpoint of an investor. Who in their right mind would buy a German 10-year at -30 bps in “yield?”

You have to realize that instead sovereign bonds are not an investment, at least not among the primary class of owners which is mostly big global banks. Demand for them has little or nothing to do with fundamental characteristics like the credit risk of their issuer. In the case of UST’s, the federal government is the brokest entity in history and it’s not even close; by most legitimate accounting measures to the point of being near insolvent if not there already.

Little of that matters in today’s price of any UST security. These are nothing more than balance sheet tools; ballast for what’s left of global banking behemoths to manage their risks. Paramount among these is, contrary to mainstream perception, liquidity risk.

The analogy of ballast is a good one. An ocean-going ship will take on water in the face of an onrushing storm. It lowers the vessel’s center of gravity making it more stable in very rough seas. Even though it reduces the ship’s speed as well as efficiency, increasing the costs of the voyage, it’s worth the price to reduce the chances of foundering (ending up like Bear Stearns).

The second required piece of perspective along these lines relates to QE. It wasn’t ever money printing. Sorry, but no. As a technical money matter, QE was an abject failure because at best it was nothing more than an asset swap; and not a very good one, either.

The general public might not see it this way but only because they’ve been told over and over and over by “everyone” that central bank balance sheet expansion was the same thing as the printing press. Global banks don’t have the luxury of being so blind (the lesson of Bear Stearns). Technical money matters, even if we and they struggle to ever define it (let alone locate it).

When viewed in this way, there is never any conundrum about the behavior of interest rates. What all those bond kings never factor is what really drives bonds. They take their cues instead from central bank “scholarship.”

TIC already tells us something big is going on likely in the offshore interbank eurodollar space. Where else can we look for corroboration as well as maybe some more detail about it? Perhaps, even, some data putting the dollar shortage together with demand for UST’s beyond the surface concept of flight to safety (which is very well established).

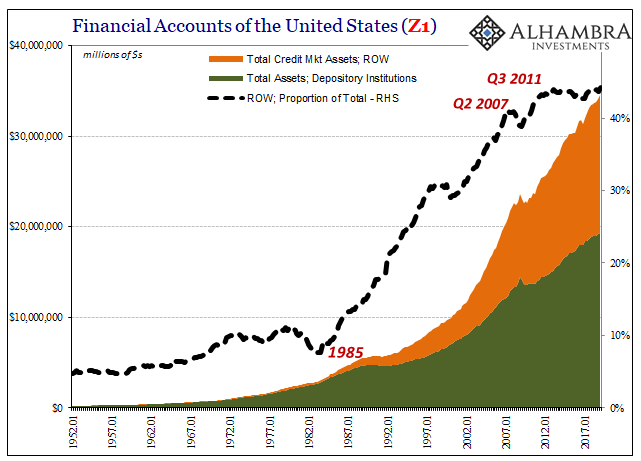

One other often valuable data series is, paradoxically, maintained by the Federal Reserve. It used to be called the Flow of Funds. Today, it is titled differently as the Financial Accounts of the United States, though remaining classified throughout as Z1. This is a huge volume of comprehensive data aimed at estimating and categorizing as much of the US financial system as may be humanly possible.

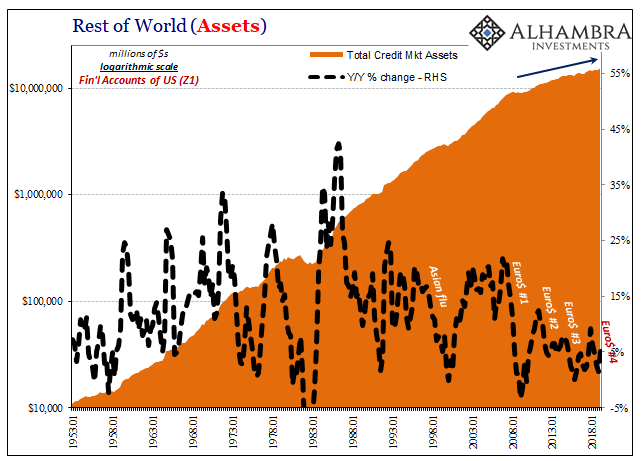

What most people may not realize is that the foreign sector had long ago become a pivotal piece of the domestic financial picture. Eurodollar growth was more than just dollars offshore; they may have started there and may have been traded in these long chains of bank liabilities stretching around the world, but more and more over time eurodollars landed onshore, too.

In figures recently updated to include those from Q1 2019, the Z1 estimates tally the amount of financial assets of all kinds held by domestic depository institutions (a class which today includes both the traditional types of banks, which always had fallen under this label, as well as what used to be known, and treated separately, as commercial banks; also called investment banks). The total for the first quarter was $19.3 trillion.

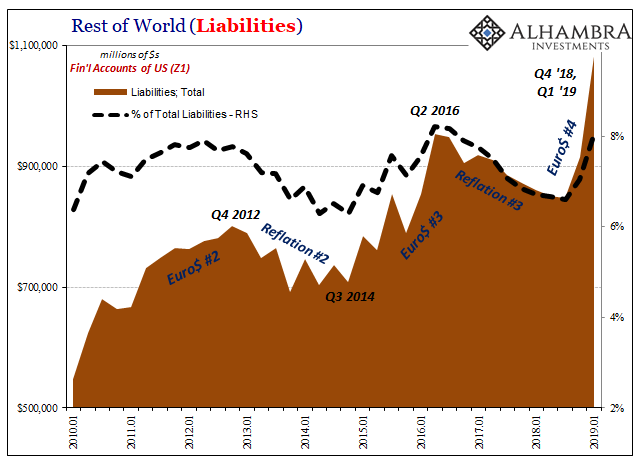

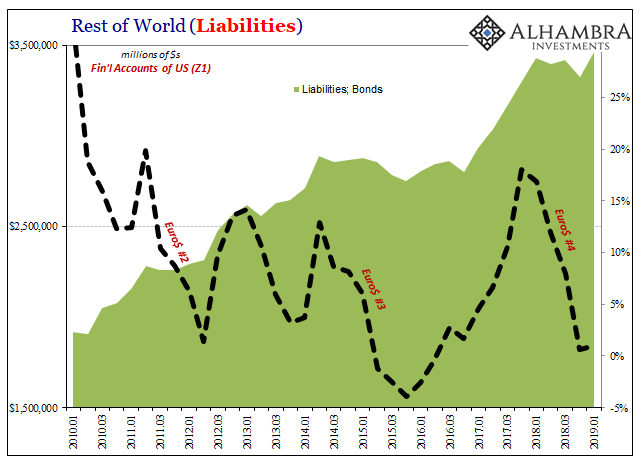

The total amount of financial assets held by the Rest of the World (ROW)? An astounding $28.6 trillion. If we only include credit market assets (as shown in the charts here), excluding stocks and mutual funds, it’s still $15.3 trillion – nearly as much as all the country’s domestic banks. There’s an awful lot of domestic activity in the eurodollar system.

And, as you can see above and below, it’s very different after 2008 than before.

One of the primary reasons is liquidity risk. You can observe it on the chart above, the oscillations up and down coincident to these global dollar shortages we find in a broad cross section of data, market prices, and otherwise economic behavior (the very things I submitted in evidence for my recent academic paper). This world-spanning monetary system can never get going very far or very fast before it is turned back.

Ben Bernanke was right about this one thing; economic recovery after the Great Financial Crisis (the first dollar shortage) would only be possible with a full and complete recovery in the financial system. What he didn’t say over the final tumultuous years of his tenure was how his central bank as well as others around the world could not, and did not, meet the technical monetary requirements for any of that to happen.

They would rely instead on the puppet show.

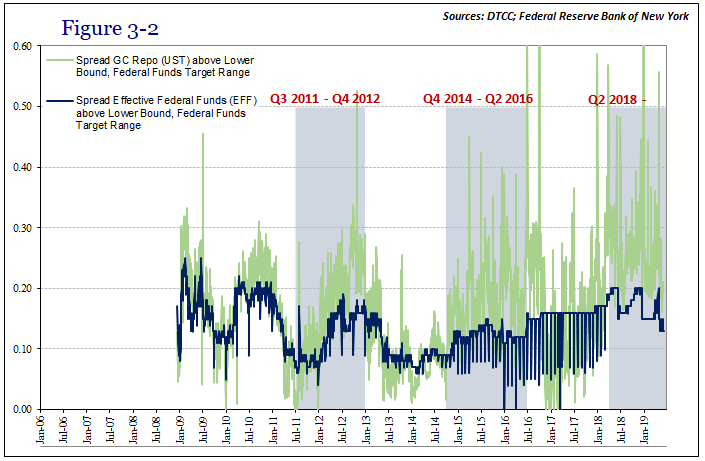

One of the central themes of my paper is the repo market. As it turned out, repo has been a sort of nemesis for central bankers all along. In 2011, for instance, the FOMC debated what would have amounted to a repo market bailout (and what today is being considered as a standing repo facility) because of clear problems in this crucial monetary area.

On August 1, 2011, during an emergency conference call, Chairman Bernanke said:

I think a point that was somewhat underemphasized is that our transmission of monetary policy is an issue here as well. So to take an example, doing repos to keep the RP rate from uncoupling from the federal funds rate, arguably there are issues there relating to transmission.

As then-Manager of Open Market Operations Brian Sack would note, several times, this was taking place with $1.6 trillion in bank reserves having been created by the first two QE’s. Huge liquidity pressures in repo no matter the level of bank reserves. Eight years later, we observe the same pressures.

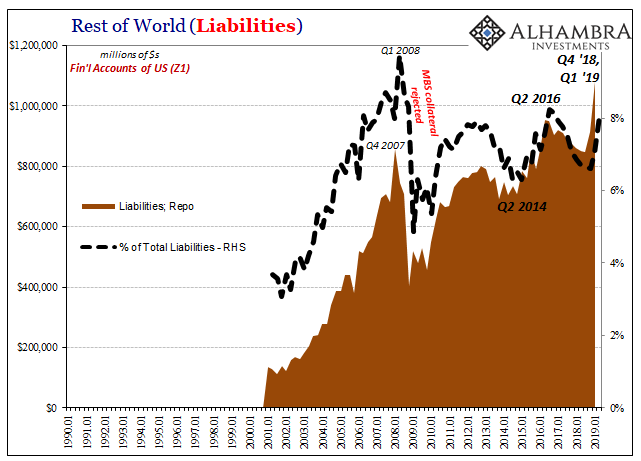

Repo adds another dimension. There is a cash side to it as well as a collateral side. The Z1 figures on ROW (offshore) repo liabilities show us the latter in 2008 as collateral abandonment (above). A huge decline in them once MBS securities of all varieties and vintages were revalued, repriced, and too often outright rejected in repo usage. It unleashed an often-desperate scramble for UST’s and the like as the only alternates.

With MBS securities having been largely excised from the acceptable list, the “pristine” forms of collateral have been left as largely sovereign bonds alone (and agency MBS). This is true as the basis for collateral transformation, too, though I won’t get it into that in depth in this discussion (you can go here for specifically this part).

What stands out is the obvious pattern, including and especially the last two quarters of data – those for Q4 2018, the landmine, and Q1 2019. It was a massive spike in reported repo liabilities coming from outside the US boundary. And it was consistent with what had already happened during Euro$ #2 and more so Euro$ #3 (which registered more in Asia and EM’s than the US or Europe).

But wait; repo liabilities are rising sharply during periods we’ve otherwise identified as a having a dollar shortage. This might appear to be backward and inconsistent. If there is an offshore dollar problem, how can offshore financial counterparties have picked up an extra $235 billion, an increase of almost 30%, in those two quarters alone?

We have to keep in mind ballast and balance sheet tools. A bank’s overall balance sheet is a complex amalgam of many different sometimes competing priorities and goals. On the liability side, there is a definite if loosely defined structure or hierarchy. You want to fund your assets as cheaply and as efficiently as possible while at the same time keeping a wary eye on the vulnerabilities of doing so.

In other words, bank liabilities are a complicated tangle of different forms. Should you lose some, you have to replace them somewhere else. Even if all you’re worried about is the potential for losing some, as a preventative measure you source more stable alternatives.

The risks embedded within them have been, again, heightened in the post-crisis era by first Bear Stearns and second by QE doing nothing as far as effective money has been concerned. In short, when the market for overall funding in all its forms becomes more uncertain, you need ballast and fast.

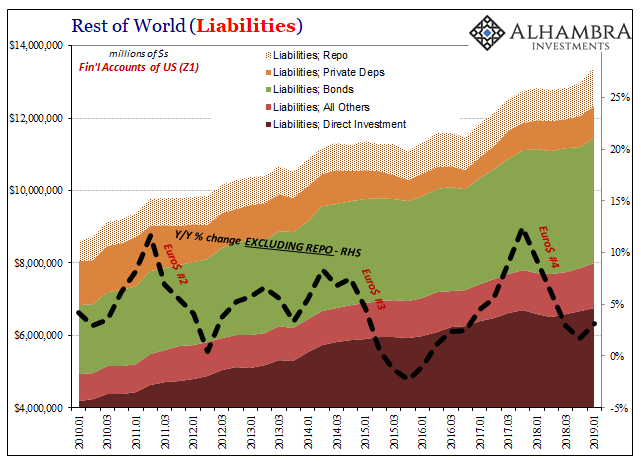

Repo is the plugline or balance on top of a large pyramid of dollar liabilities, the various ways foreign entities (beyond strictly financial firms) fund their activities using the denomination. There’s the direct investment of US businesses in foreign enterprises, private dollar deposits that flow outside the US, corporate bonds including Eurobonds, as well as several other types.

What we observe here, as well as other data, is how the repo market is the last line of liquidity defense in the offshore world. It has become the lender-of-last-resort because the central bank cannot be counted on for what used to be its primary use (raising the question, are central banks, in fact, useless? This isn’t just a rhetorical flourish on my part, it is a legitimate doubt.) This was the major evidence of 2008, reinforced a second time, echoing Bernanke’s bewilderment about transmission, in 2011.

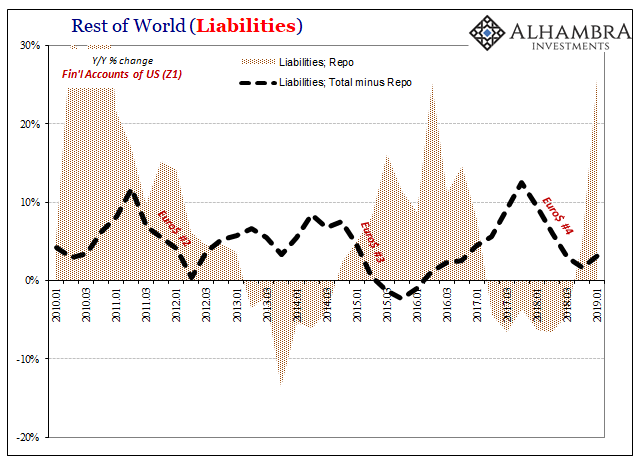

Total dollar liabilities (ex repo) rise and fall keeping exactly to the eurodollar schedule; dollar shortages mixed with the occasional reflationary interim. When dollars become scarce in these other forms of liabilities, banks and financial agents in the offshore world go running into repo.

In the post-crisis era, growth in repo liabilities is highest when growth in all other forms of dollar liabilities are lowest. That’s why repo liabilities are rising even though we cannot help but note a dollar shortage. It’s not the repo market which is short of dollars; it is everywhere else. The rest of the system, including mostly hidden forms like FX and other derivatives, footnote dollars, which are almost entirely absent from the data, is exerting funding pressures which come out as repo demand.

Some or much of that pressure is coming from, as I’ve been talking a lot about, offshore corporate bonds (from the perspective of the issuer).

The Eurobond binge of 2017 reversed in 2018 and no doubt that retrenchment is a major factor in firms getting pushed into repo as that last resort. If after Euro$ #3 foreign dollar demand came to depend upon Eurobonds as a workaround when eurodollar bank channels were reduced or shuttered, what happens when the Eurobond market dries up, too?

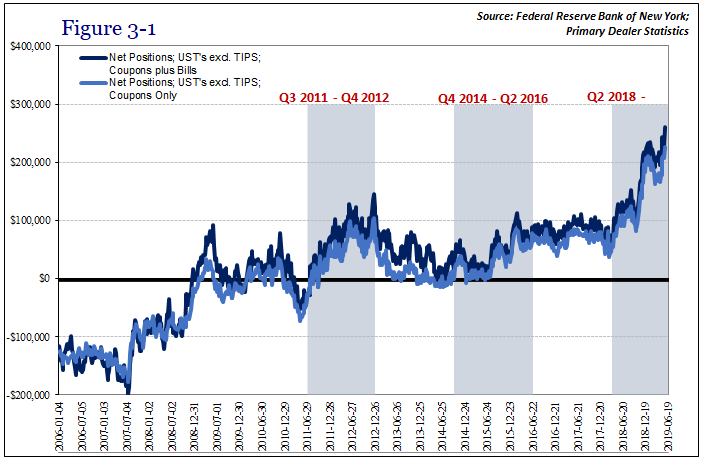

But in order to be able to access repo you have to have the accepted collateral. It amounts to what may look like a collateral squeeze; an occurrence that has been especially acute during this Euro$ #4, as indicated by primary dealer UST holdings. As I wrote in my paper:

When liquidity is regarded more generally with uncertainty or suspicion, repo participants which include not just cash borrowers but also securities lenders (those often engaged in parallel collateral transformation) tend to demand these “pristine” forms of collateral like US Treasury securities as a safeguard or as replacement for securities further down the chain which are being re-evaluated as acceptable collateral (and on what terms).

This added demand for US Treasuries independent of long-range forecasts describes an inherent liquidity quality to the securities themselves at all points on the yield curve.

As liquidity of last resort, it also means demand on the cash side as well as the collateral side. This is why you see the repo rate rise during these dollar shortages. With nowhere else to turn, demand for repo cash (once collateral is secured, including being rented) becomes excessive. And the supply of that cash is itself limited for the same reasons (the incestuous nature of this global system).

Why was the GC (UST) repo rate 289.9 bps above RRP on December 31? It had nothing to do with 2a7, it was because (mainly) offshore dollar participants had nowhere else to go and banks (everywhere) who might normally supply funding were skittish for reasons of year-end and more importantly the general nature of liquidity during what really was the detonation of a (eurodollar) landmine.

To review: the TIC bank-level data tells us that bank liabilities of all kinds are being withheld and severely curtailed. The headline TIC shows the potential dollar shortage offshore leading to more broad financial consequences, including foreign central banks (not just China) having to sell and otherwise mobilize reserves to try and deal with it as best they can (which is not very well).

The shortage is corroborated in the Z1 data in a variety of ways, including the ROW sector as a close approximation of what parts that offshore world deals with the US domestic system. And most of all, when the dollar shortage across all liabilities becomes so acute, it is the repo market which many turn to for the lender-of-last-resort functions any competent central bank would have supplied (a working mechanism).

Thus, we have the answer for federal funds, too. When everything else is exhausted, the sparest of spare liquidity suddenly becomes highly demanded; the last ripples of illiquidity emanating from deeper inside the shadow money world of offshore eurodollars.

I told you last year it was never T-bills. The most ironic part of all: it’s the Fed’s very own Z1 data which drives the final nail in the Fed’s embarrassing cover up. One that is just now really starting to unravel.

There’s your looming rate cut(s). Even these central bankers now see how there’s something much bigger going on here. Since they are always the last to figure it out, ask yourself, what’s really going on in the shadows which has finally grabbed even Jay Powell’s concern?

It ain’t T-bills.

Stay In Touch