For the first time, it was encouraging to see and hear quite a lot of people talking about the September calendar quirk. That’s progress; a small but noticeable segment of the financial public setting aside the mythical dogma of bank reserves and asking the right questions.

However, I fear that having been “disappointed” by this year’s version of it, how many will end up concluding it was all nothing to begin with? In short, expectations were high (pushed higher by WTI) that something would happen right around…today.

I just didn’t see it that way, and it was the all-important T-bill market more than anything which had indicated very little along those lines.

The only thing which did occur today was another absurd FOMC performance; hardly the fireworks many had been imagining. Monetary officials did make further fools out of themselves trying to convince you, me, and the rest of the world how forward guidance, a symmetrical inflation target, and an average inflation target aren’t just different terms describing the same stupid idea.

Other than that, it may be hard to reckon why September 2019 was so full of obvious monetary disorder when September 2020 hasn’t been; considering the fact that the world is in so much worse shape this year than last.

Context, direction, and momentum, however, these all matter a great deal. The global eurodollar system, indeed the entire global economy, had begun September 2019 on a serious downswing; remember, the “recession scare” of August 2019 had reached its climax around September 4. In other words, money dealers were already on their back foot, getting more nervous heading toward the seasonal mid-month ebb.

Not only that, whatever you might make of monetary policy and monetary policymakers, they likewise were trying desperately to catch up to events offering only the one rate cut to counteract the growing downside momentum by then clearly visible even in the vaunted, unemployment-rate-awesome United States.

There was simply nothing positive for dealers to hang their hat on by the time that low point was reached; and they reacted to that unusual low point in predictable fashion just as I wrote one year ago. The very moment the going got rough, dealers left an increasingly enormous repo rate profit on the table and went home for the day. Stayed home the next day. And the day after.

It was all a dress rehearsal for what would happen in March 2020 – GFC2. And GFC2 was actually made all the worse by how the Fed responded to September 2019’s repo rumble. And that’s really the story about the FOMC today, which I’ll get to in a minute.

First, though, September 2020 has been a breeze compared to last year even though more and more it looks like the global economy is running out of reopening momentum and will be lucky to recover (in the technical sense; not in any meaningful sense) by 2023.

How can we be in so much worse shape and yet last year was the messy mid-point?

The answer is, primarily, reopening momentum which includes all the things the Federal Reserve has done which to some people looks like inflationary liquidity. Last year: one rate cut. This year: floods, buying up markets, and trillions. Unlike September 2019 when momentum (and fear) was all on the bad side, in September 2020 momentum is all positive and uncertainty is right now about just how positive. If risk-aversion is the key, where are risks being set?

I don’t believe it and I don’t believe many in the bond market believe it, either, meaning money dealers, but as of mid-September 2020 it cannot be so easily discounted especially when by and large all the big negatives are behind us. Wondering about the slope of a rebound is very different from wondering about the possible depths of a potential recession; this year, we’ve already experienced them.

A big part of that is how the Fed completely, utterly botched its response to last year’s repo rumble. Not just screwed up, but demonstrably made GFC2 so much worse than it ever “needed” to be. And because March 2020 was so unnecessarily bad, just getting out of it has induced all the weeks and months up to at least September 2020 into what amounts to survivor’s euphoria.

This still lingers today, maybe not as powerfully, as we can see in places like the NYSE. I believe that accounts for the very different experience between September 2020’s calendar quirk and September 2019’s.

In between, Fed officials only starting with Jay Powell had responded to last year’s repo market disruption in the way they always respond to everything – bank reserves. There were “repo operations” that weren’t repo market operations, and, more than anything, not-QE.

Remember specifically what not-QE had been. To distinguish between a QE and a not-QE, these charlatans purposefully bought exclusively T-bills, staying away from Treasury bonds because buying bonds rather than bills would have signaled something different. Or something.

That didn’t really matter because the whole thing was an obvious blunder given what had technically brought about the September 2019 repo rumble in the first place.

Back on September 17 last year, while all this was still taking place, I said:

I’ve written all year how it seems like the bond market has been spooked about something. The bond market is dealer banks (more than specifically primary dealers). They have become more and more shy about liquidity functions (which, we can now see since it was ended six weeks ago, had nothing to do with QT).

Not federal funds. Not calendar bottlenecks. Repo. Collateral bottlenecks.

That was the warning of mid-September 2019; and, predictably, not only did monetary officials fail to heed it they then went on to do the opposite of what the system was warning them, and everyone, about. Officials via not-QE would go on to strip the collateral system of more and more precious T-bills, all as the troubled global dollar system drew closer and closer to the shock of February and March 2020.

The Federal Reserve increasingly weakened the global monetary system, making it all the more fragile as it approached a big one.

I wrote in early October:

Over here in reality, the Fed will be simultaneously increasing the level of irrelevant bank reserves, removing top-notch T-bill collateral dealers don’t want to part with, all while not appearing to stimulate an economy quite badly in need of some kind of actual aid.

It’s hard not to think sometimes that maybe the conspiracy theorists are on to something here. When you step back and look at what they are doing, there are moments when you truly wonder if authorities are actually trying to crash the system. At least to make a bad situation that much worse.

The whole bond market screams systemic collateral shortage and these guys think, well, let’s fix it by…removing the best collateral from circulation. Can anyone in such a position really be that obtuse? It has to be on purpose, right?

How about March 3, just as GFC2 was about to take off?

At the slightest little hiccup in September, a dress rehearsal, they [dealers] pulled their limited, precious balance sheet capacities out of the repo market – at almost any price.

In February and now March 2020, the same thing is disappearing. Except, it’s not just or even much repo. It’s disappearing from everywhere at the moment. Liquidations galore. The very thing September’s repo dress rehearsal was rehearsing.

The level of bank reserves? Substantially higher than September, of course.

And so on and so on; numerous other examples predicting the utterly predictable folly and danger of not-QE. More than that, monetary policy with not a single penny of usable money in it.

Lo and behold, March 2020 (starting late February) rolls around and there’s such a scramble for especially T-bills (and other OTR UST’s) it freezes while nearly crashing the entire global system in a manner just like GFC1’s worst parts.

The bottleneck was real!

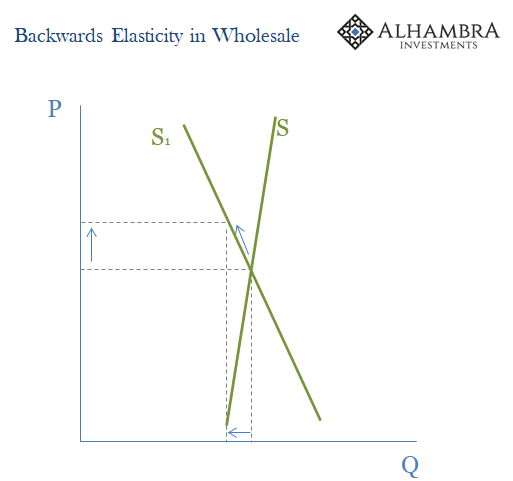

The September 2019 repo rumble had revealed just how fearful money dealers had become over the mere possibility. The monetary authority responded to that dress rehearsal by making the potential bottleneck’s disastrous potential that much more disastrous. Currency elasticity is supposed to be the opposite, instead a fixation on irrelevant, inert bank reserves when here we can now fully establish and demonstrate just how the central bank had instead created the fertile conditions for backwards elasticity and left them for the worst possible time.

But monetary policymakers today want to talk about average inflation targeting and enhanced forward guidance, and they will be able to get away with it today because September 2020 unlike September 2019 hasn’t given the public an obvious reason not to let them. Another side to survivor’s euphoria.

And the lack of that obvious reason can be understood because of what really did happen in between, six months ago at the last big calendar quirk in mid-March when everything was on the downswing. The collateral bottleneck proved to be the real deal, and now the global economy suffering the consequences of it. The long run damage this will cost, in lack of recovery, we won’t know for years.

That kind of raw uncertainty, just the sprinkle of positive potential, has done September 2020, at least, a huge favor. October? Check the T-bills.

The reason the Fed can never hit its inflation target is the insane level of incompetence and dereliction that has actually been on full display for this last entire year. Though Aristotle wasn’t an idiot, so neither is Jay Powell, this only explains; it doesn’t in any way excuse.

Inflation shows up only when the Fed is finally made to answer for both September 2019 and September 2020. Given how no one over there has ever been seriously challenged as to September 2008, like inflation, this remains more of a long run goal.

Either way, awareness of mid-September potential is real progress.

Stay In Touch